(2015) 390 KLW 790

IN THE HIGH COURT OF KERALA AT ERNAKULAM

PRESENT: THE HONOURABLE MR. JUSTICE P.UBAID

SATURDAY, THE 20TH DAY OF DECEMBER 2014/29TH AGRAHAYANA, 1936

WP(C).No. 38400 of 2010 (Y)

PETITIONER(S)

1. SANTHOSH & ANOTHER

BY ADVS.SRI.M.G.KARTHIKEYAN SRI.C.C.THOMAS

RESPONDENT(S)

1. STATE OF KERALA & OTHERS TAXES (A) DEPARTMENT, GOVT. OF KERALA GOVT. SECRETARIAT,THIRUVANANTHAPURAM.

2. THE EXCISE COMMISSIONER, COMMISSIONERATE OF EXCISE, THIRUVANANTHAPURAM.

3. THE DEPUTY COMMISSIONER OF EXCISE, ERNAKULAM.

4. THE EXCISE INSPECTOR, EXCISE RANGE OFFICER, MATTANCHERRY ERNAKULAM DISTRICT.

5. THE DIRECTOR OF RESEARCH, KERALA AGRICULTURAL UNIVERSITY, MAIN CAMPUS VELLANIKKARA, KAU P.O., PIN-680 656 THRISSUR DISTRICT.

BY GOVERNMENT PLEADER SMT.SAREENA GEORGE P. R5 BY ADV. SRI.BABU JOSEPH KURUVATHAZHA,SC,KERALA AGRICULTURAL UNIVERSITY R1 -R 4 BY ADV. TOM JOSE PADINJAREKKARA ADDL.DIRECTOR GENERAL OF PROSECUTION R BY SRI.K.P.MUJEEB, SC, KERALA AGRI UNIVERSITY

JUDGMENT

Being proceedings involving a common question of law under the

Kerala Abkari Act

(for short 'the Act) and the

Kerala Abkari Shops (Disposal in Auction) Rules 2002

(for short 'the Rules'), these cases were heard together, and are being disposed of by this common judgment.

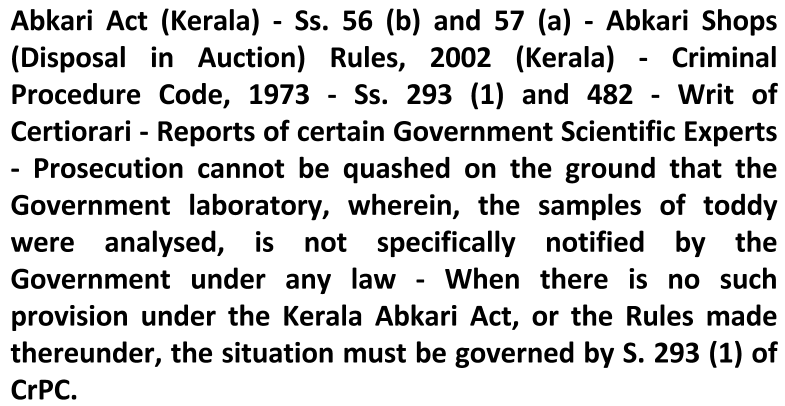

2. The Excise Inspectors of different Ranges in Kerala lifted samples of toddy from different toddy shops on different dates, as part of a drive to examine the quality of toddy being sold under license in Kerala. On analysis of the samples of toddy in the laboratory those samples were found containing starch. On the basis of the report of analysis, the Excise Department, through different Excise Inspectors initiated prosecution and registered crimes under

Sections 56 (b) and 57 (a) of the Act against the licensees and salesmen of those toddy shops.

3. Section 56 (b) of the Act reads as follows:

(a) xxxxxxxx

(c) xxxxxxxx

(d) xxxxxxx

(e) xxxxxxx

Whoever being the holder of licence for the sale or manufacturer of liquor or of any intoxicating drug under this Act.

(a) mixes or permits to be mixed with the liquor or intoxicating during, sold or manufactured by him, any drug, other than a noxious drug or any ingredient likely to add to its actual or apparent intoxicating quality or strength, or any article prohibited other than an article which the Government shall deem to be noxious by any rule made under Section 29, clause (k), when such admixture shall not amount to the offence of adulteration under Section 272 of the Indian Penal Code.

(b) xxxxxxxx

(c) xxxxxxxx

(d) xxxxxxx

5. Section 24 of the Act provides that every license or permit granted under the Act shall be subject to such restrictions and conditions as prescribed under the Act and the Rules made thereunder.

6. Rule 2(n) of the Kerala Abkari Shops Disposal Rules, as it stands amended in 2007, contains the definition of Toddy, that Toddy means fermented juice drawn from any Coconut, Palmyra, or Choondapana palms, and conforming to such specification and restrictions as may be notified by Government, based on scientific studies and Indian Standard Specifications. Thus it is quite clear that any licensee or salesman found selling toddy, which does not conform to the definition of toddy under Rule 2(n) of the Rules, or which does not conform to the standards prescribed under Rule 9(2) of the Rules can be prosecuted under Section 56(b) of the Kerala Abkari Act. Such a person can also be prosecuted under Section 57(a) of the Act, for violation of Rule 9(2) of the Rules which reads as follows, after the amendment made to the Rules in 2007 (2) No toddy other than that drawn from Coconut, Palmyra or Choondapana palms and on which tree-tax due under the Act has been paid shall be sold by the licensee. All toddy kept or offered for sale shall be natural and conforming to such specifications, and complying to such restrictions as may be notified by Government under clause (n) of Rule 2. Nothing shall be added to it to increase its intoxicating quality or strength or to alter its natural composition or for any other purpose.

7. Thus adding anything to toddy with the object of increasing its intoxicating quality or strength, or altering the natural composition of toddy for any other purpose, will amount to violation of Rule 9(2) of the Rules, and consequently it will invite prosecution under Section 57(a) of the Kerala Abkari Act. What all things shall not be added to toddy to increase its intoxicating quality or strength, or to alter its natural composition or for any other purpose, will have to be notified by the Government under Clause (n) of Rule 2. Rule 2(n) of the Rules authorises the Government to make such notification. In exercise of such powers, the Government issued a notification on 14.2.2007 as SRO 145/2007 in G.O(P) No.25/2007/TD. Clause 4 of the said notification provides that toddy shall be free from any added colouring, flavouring, sweetening or other foreign matters; starch; chloral hydrate; paraldehyde; sedatives, tranquilizers, and any other Narcotic Drugs or Psychotropic Substances; and any ingredients injurious to health. Thus by notification issued on 14.2.2007, the Government of Kerala has made addition of materials including starch to toddy, an act of violation of Rule 9(2) of the Rules, and consequently such an act is made punishable under Section 57(a) of the Act. No doubt, adding starch to toddy will alter its natural composition. Section 3 (8) of the Act generally defines what toddy, is and Rule 2(n) of the Rules defines what toddy is, for the purposes of the Rules. Anything added to alter the natural composition of toddy for whatever purpose will amount to violation of Rule 9(2). One cannot have a misapprehension that adding noxious and poisonous substances alone will constitute the act of adulteration. Adding anything to the basic ingredients or the natural composition of toddy, or adding anything alien, which is not permitted under the Act, or the Rules framed under the Act, with the object of changing the natural composition or basic ingredients of toddy, will amount to an act of adulteration. Much thought is not required to find that adding starch to toddy, with the dishonest object of increading the quantity, and thereby making unlawful profits dishonestly, will amount to adulteration meant under the law and it will definitely amount to violation of Rule 9(2) of the Rules.

8. What is under challenge in these proceedings is the validity of Rule 9(2) of the Rules as amended in 2007, and supplemented by the Government notification issued on 14.2.2007, referred to above.

9. In the writ proceedings the writ petitioners seek a declaration that the Government notification SRO No.145/2007 in G.O(P) No.25/2007/TD dated 14.2.2007, and also the Government notification No.SRO No.144/2007 in G.O(P) No.24/2007/TD dated 14.2.2007, amending Rule 9(2) of the Rules are invalid, and ultravires the rule making powers of the Government, and also a writ of certiorari quashing those notifications. They also seek orders quashing the crimes registered against them. In the batch of Criminal Miscellaneous Cases also the petitioners seek orders under Section 482 of the Code of Criminal Procedure quashing the crimes registered by the Excise Inspectors under Section 56(b) and 57(a) of the Kerala Abkari Act.

10. In the nature of the contentions raised by the writ petitioners and the other petitioners, the main question for consideration in these proceedings is whether the amendment brought by the Government to Rule 9(2) of the Rules by Government notification dated 14.2.2007 is within the rule making powers of the Government, and also whether the notification issued by the Government on the same date prohibiting addition of starch and other materials to toddy, is within the powers of the Government. In short the question is whether the above notifications are ultra vires the rule making powers of the Government. If it is found that it is ultra vires the powers of the Government, all the proceedings will have to be allowed, and consequently the different crimes registered by the Excise Department against these petitioners will have to be quashed. If the finding is otherwise that those notifications are well within the rule making powers of the Government, all these petitions including the writ petitions will have to be dismissed, and consequently the prosecution brought by the department against these petitioners will have to continue, of course subject to other proceeding under the Code of Criminal Procedure, and without prejudice to the right of the petitioners to seek any other appropriate remedy possible under the Code of Criminal Procedure, including the right to plead for discharge on any factual or other legal ground.

11. The facts need not be discussed in detail because answer to the question of law raised by the petitioners will decide all these proceedings. Still the essential facts will have to be mentioned. The writ petitioners in W.P (C) No.38400 of 2010 are the salesman and the licensee of Toddy Shop No.14 in Group No.II of Mattancherry Excise Range. Sample was taken from the said toddy shop on 16.8.2010. The petitioners are the accused in CR No.30 of 2010 of Mattancherry Excise Range, registered under Sections 57 (a) and 56 (b) of the Kerala Abkari Act. The petitioners in W.P ) No.9142 of 2011 are the Manager and the licensee of Toddy Shop No.71 of Changanassery Excise Range. Sample from the said shop was taken on 17.9.2010 by the Excise Inspector. They are the accused in Crime No.71 of 2010 of Changanacherry Excise Range registered under Section 57 (a) of the Act. The writ petitioners in W.P. ) No.5546 of 2011 are the salesman and the licensees of Toddy Shop No.25 of Cherthala Excise Range. Sample of toddy from the said said shop was taken on 13.8.2010. These petitioners are the accused in Crime No.80 of 2010 of Cherthala Excise Range registered under Section 57 (a) of the Act. The writ petitioners in W.P (C) No.2544 of 2012 are the licensee and the salesman of Toddy Shop No.6 of Cherpulassery Excise Range. Sample of toddy from the said shop was taken on 9.9.2011. These petitioners are the accused in Crime No.43 of 2011 of Cherupulassery Excise Range registered under Sections 56 (b) and 57 (a) of the Act.

12. The petitioners in Crl.M.C No.6531 of 2013 are the salesman and the licensees of Toddy Shop No.4 of 2012- 13 of Pinarayi Excise Range. They are the accused in Crime No.52 of 2013 of Pinayrayi Excise Range, registered under Sections 56 (b) and 57 (a) of the Act. Sample from the said toddy shop was taken on 18.9.2013. The petitioners in Crl. M.C No.6562 of 2013 are the salesman and the licensees of Toddy Shop No.4/2012-13 of Pinarayi Excise Range. They are the accused in CR.No.49 of 2013 of Pinarayi Excise Range registered under Sections 56 (b) and 57 (a) of the Act. These petitioners are also the accused in CR 52 of 2013. The petitioners in Crl.M.C No.6569 of 2013 are the salesman and the licensee of Toddy Shop No.18/2012-13 of Pinarayi Excise Range. They are the accused in Crime No.53 of 2013 of the said Range, registered under Sections 56 (b) and 57 (a) of the Act. The petitioners in Crl.M.C No.137 of 2014 are the salesman and the licensee of Toddy Shop No.10/2012-13 of Thalassery Excise Range. They are the accused in CR No.63 of 2013 of the said Range registered under Sections 56 (b) and 57 (a) of the Act. The petitioners in Crl.M.C No.582 of 2014 are the licensees of Toddy Shop No16/2012- 13 of Peravoor Excise Range. They are the accused in Crime No.91 of 2013 of the said Range, registered under Section 57 (a) of the Act. The petitioners in Crl.M.C No.583 of 2014 are the salesman and the licensees of Toddy Shop No.20/2012-13 of Kannur Excise Range. They are the accused in Crime No.99 of 2013 of the said Range, registered under Section 57 (a) of the Act. The petitioner in Crl.M.C No.643 of 2014 is the licensee of Toddy Shop No.83/2012-13 of the said Range registered under Sections 56 (b) and 57 (a) of the Act. Sample from the said shop was taken on 23.8.2012. The petitioners in Crl.M.C No.1227 of 2014 are the licensees of Toddy Shop No.40/2012-13 of Perinthalmanna Excise Range. They are the accused in Crime No.10 of 2014 of the said Range, registered under Section 57 (a) of the Act. The petitioners in Crl.M.C No.1231 of 2014 are the licensees of Toddy Shop No. 37/2012-13 of Perinthalmanna Excise Range. They are the accused in C.R No.11 of 2014 of the said Range registered under Section 57 (a) of the Act. The petitioners in Crl.M.C No.1331 of 2014 are the licensees of Toddy Shop No.12/2012-13 of Perinthalmanna Excise Range. They are the accused in CR No.12/14 of the said Range, registered under Section 57 (a) of the Act. The petitioners in Crl.M.C No.2324 of 2014 are the licensees of Toddy Shop Nos.30 to 32, 35, 63 and 66 of 2012-13 of Sreekandapuram Excise Range. They are the accused in CR.24/14 of the said Range, registered under Sections 56 (b) and 57 (a) of the Act. The petitioners in Crl.M.C No.3077 of 2014 are the Manager and the licensee of Toddy Shop No.23/2013-14 of Kunnamkulam Excise Range. They are the accused in Crime No.24 of 2014 of the said Range registered under Sections 56 (b) and 57 (a) of the Act. The petitioners in Crl.M.C No.3078 of 2014 are the Manager and the licensees of Toddy Shop No.57/2012-13 of Kunnammulam Excise Range. They are the accused in CR No.25 of 2014 of the said Range, registered under Sections 56 (b) and 57 (a) of the Act. The petitioners in Crl.M.C No.4271 of 2014 are the licensee and the salesman of Toddy Shop No.33/2014-15 of Ottappalam Excise Range. They are the accused in CR No.46 of 2014 of the said Range, registered under Section 57 (a) of the Act. The petitioners in Crl.M.C No.4360 of 2014 are the Manager and the licensee of Toddy Shop No.7/2014-15 of Cherpu Excise Range. They are the accused in CR No.31/2014 of the said Range registered under Sections 56 (b) and 57 (a) of the Act. The petitioners in Crl.M.C No.4459 of 2014 are the Manager and the licensee of Toddy Shop No.16/2013-1413 of Mala Excise Range. They are the accused in CR No.24/2014 of the said Range registered under Sections 56 (b) and 57 (a) of the Act. The petitioners in Crl.M.C No.4460 of 2014 are the salesman and the licensees of Toddy Shop No.48/2012-13 of Alathur Excise Range. They are the accused in CR No.60 of 2014 of the said Range, registered under Section 57 (a) of the Act. The petitioners in Crl.M.C No.4521 of 2014 are the licensee and the salesman of Toddy Shop No.44 of 2013-14 of Thrithala Excise Range. They are the accused in CR No.36 of 2014 of the said Range registered under Section 57 (a) of the Act. The petitioners in Crl.M.C No.4522 of 2014 are the licensee and the salesman of Toddy Shop No.44/2013-14 of Thrithala Excise Range. They are the accused in CR No.18 of 2014 registered under Section 57 (a) of the Act. The petitioners in Crl.M.C No.4523 of 2014 are the licensee and the salesman of Toddy Shop No.44 of 2013-14 of Thrithala Excise Range. They are the accused in CR No.37 of 2014 of the said Range, registered under Section 57 (a) of the Act. The petitioners in Crl.M.C No.4922 of 2014 are the salesman and the licensee of Toddy Shop No.64/2014 of Vadakkancherry Excise Range. They are the accused in CR No.64 of 2014 of the said Range registered under Sections 56 (b) and 57 (a) of the Act. The petitioners in Crl.M.C No.4958 of 2014 are the licensee and the salesman of Toddy Shop No.30/2014-15 of Thodupuzha Excise Range. They are the accused in CR No.47 of 2014 of the said Range, registered under Section 57 (a) of the Act. The petitioners in Crl.M.C No.5056 of 2014 are the licensee and the salesman of Toddy Shop No.3/2012-13 of Feroke Excise Range. They are the accused in CR No.6 of 2014 of the said Range, registered under Sections 56 (b) and 57 (a) of the Act. The petitioners in Crl.M.C No.5059 of 2014 are the salesman and the licensee of Toddy Shop No.32/2012-13 of Vadakkancherry Excise Range. They are the accused in CR No.65 of 2014 of the said Range registered under Sections 57 (a) and 56 (b) of the Act. The petitioners in Crl.M.C No.5181 of 2014 are the salesman and the licensee of Toddy Shop No.60/2014-15 of Perumbavoror Excise Range. They are the accused in CR No.90 of 2014 of the said Range, registered under Section 57 (a) of the Act. The petitioners in Crl.M.C No.5482 of 2014 are the salesman and the licensess of Toddy Shop No.29/2014-15 of Thripunithura Excise Range. They are the accused in CR No.48 of 2014 of the said Range, registered under Sections 56 (b) and 57 (a) of the Act.

13. Samples of toddy from the different shops were collected on different dates On analysis in the laboratory, starch content was found in the samples taken from all these toddy shops. Addition of materials like starch being an offence punishable under Section 57 (b) of the Act in view of the amendment brought to the Rules in 2007, the Excise Inspectors of the different Ranges initiated prosecution against the petitioners. None of the petitioners has any dispute regarding the genuineness of the report of chemical examination showing starch content in the samples. They assail the prosecution on the question of law, that the amendment brought by the Government to the Rules in 2007 is in fact ultra vires the rule making powers of the Government. Now let us examine the relevant provisions authorising the Government to make rules and to amend the Rules.

14. Section 29 of the Act gives rule making powers to the Government. Sub-section (1) of Section 29 provides that the Government may, by notification in the Gazette, either prospectively or retrospectively, make rules for the purposes of the Act. Clauses (a) to (r) in sub-section (2) contain the different matters to which the rule making powers of the Government can extend. The relevant clause here is clause (k) which provides that the Government can make rules prohibiting the use of any article which the Government shall deem to be noxious or otherwise objectionable in the manufacture of liquor or of any intoxicating drug. Thus, Section 29 (k) of the Act is the basic provision authorising or empowering the Government to make Rules, or amend the Rules, prohibiting the use of any objectionable article or noxious substance in the process of manufacture of liquor or any intoxicating drug. Now let us go to the penal provision contained in Section 57(a) of the Act. Clause (1) of Section 57(a) of the Act specifically provides that whoever mixes or permits to be mixed with any liquor or intoxicating drug sold or manufactured by him, any ingredient likely to add to its strength, or any article prohibited by the Government by any rule made under Section 29 (k) shall be punishable with imprisonment for a term which may extend to five years, or with fine which may extend to 50,000/-. This provision will have to be read along with the definition of Toddy contained in Rule 2 (n) of the Rules, that 'Toddy' means fermented juice drawn from any Coconut, Palmyra or Choondapana palms and conforming to such specifications and restrictions as may be notified by Government on scientific studies and Indian Standard Specifications. Now let us refer to the impugned Government notification dated 14.2.2007, published as G.O(P) No.25/2007/TD in S.R.O 145 of 2007. This Government notification, in Clause (4) provides that Toddy shall be free from any added colouring or flavouring, or sweetening matters or other foreign matters including starch. Thus, addition of starch to toddy, is specifically prohibited by the said Government notification. This Government Notification was intended to achieve the purport and object of Rule 9 (2) which stood amended in 2007 by the Government notification No.24/2007/TD dated 14.2.2007 in S.R.O No.144 of 2007. After the said amendment, Sub-rule (2) to Rule 9 of the Rules provides that all toddy kept or offered for sale shall be natural, and conforming to such specifications and complying to such restrictions as may be notified by Government under clause (n) of Rule 2. Nothing shall be added to it to increase its intoxicating quality or strength or to alter its natural composition.

15. On an examination of the different provisions discussed above, and the Government Notification under challenge, I do not find anything to hold that the Government has exceeded its Rule making powers, in issuing the impugned notifications. As discussed above, Section 29 (k) of the Act gives Rule making powers to Government, and this Rule making powers can be extended to the prohibition of the use of any article which is noxious or otherwise objectionable, in the manufacture of liquor. Liquor includes toddy. The Government Notification in G.O. (P)24/2007/TD dated 14.2.2007 in S.R.O.144 of 2007 was issued by the Government in exercise of the powers conferred under Sections 18A and 29 of the Act. Just because the specific clause (k) is not mentioned in the Government Notification, it will not cease to be such a notification under clause (k), and it cannot be said to be invalid on the said ground.

16. I fail to understand why the petitioners challenge the validity of the Government Notification, amending Rule 9 (2) of the Rules. The word 'adulteration' is not specifically defined under the Kerala Abkari Act, or under Section 57 thereof. However, what is made punishable is mixing any intoxicating drug or other article prohibited by the Government by way of Rules made under Section 29 (k), with any liquor including toddy. The basic provision giving rule making powers to Government is Section 29 of the Act. Clause (k) of the said provision authorises the Government to prohibit the use of any objectionable article in the manufacture of liquor including toddy. In exercise of the powers under Section 29 (k) of the Act, the Government of Kerala issued the Government Order under challenge, dated 14.2.2007. (S.R.O144 of 2007), amending the sub-rule 2 of Rule 9, to provide that all toddy kept or offered for sale under licence issued in Kerala shall be natural, and conforming to such specifications and complying to such restrictions as may be notified by Government under clause (n) of rule 2. Power to issue notification prescribing the standards or specifications for toddy as meant under Rule 9 (2) of the Rules is derived from Rule 2 (n) of the Rules which provides by way of definition of toddy, that toddy meant under the Rules and kept for sale under licence issued in Kerala shall conform to such specifications and restrictions as may be notified by Government, based on scientific studies and Indian Standard Specifications. It was in terms of this provision, the Government of Kerala issued the Government Notification dated 14.2.2007 (SRO 145 of 2007) prescribing the specifications and standards for toddy. By this notification, the Government has fixed the permissible limit of ethyl alcohol content in toddy in clause (1), and the Government has specified in clause 4 that toddy kept or sold in Kerala under licence shall be free from any added colouring, flavouring or sweetening matters or any other foreign matters including starch, chloral hydrate etc.

17. When we read and examine the different provisions in the Act discussed above, it can be seen that the Government Notification under challenge, amending Rule 9 (2) of the Rules is well within the powers of the Government under Section 29 (k) of the Act, and that the notification in SRO 145/2007 prescribing the standards and specifications for toddy is also well within the powers of the Government under the Rules. Section 29 (k) of the Act gives rule making powers to the Government, and Rule 2 (n) of the Rules gives powers to the Government to issue notification prescribing the standards and specifications for toddy. The Government Notification SRO 145 of 2007 specifically shows that such standards and specifications were prescribed by the Government on the basis of scientific studies and Indian Standard Specifications in IS 8538:2004. Draft of the Bureau of Indian Standard Specifications as regards alcoholic drinks including toddy was made available to me during the proceedings. The second revised report of the Burea of Indian Standards provides in clause 3.1.2 that toddy shall be free from added colouring, and foreign matters. This particular standard was prescribed by the Bureau of Indian Standard with an object, that nothing shall be allowed to be added to toddy to increase its quantity deceitfully and to derive unlawful profits. No doubt, if starch is mixed with toddy, it will have a deceitful effect increasing the quantity, thereby deceiving the customers, and by the said process the cunning trader or licensee can make unlawful profit. This must definitely be prohibited, and violation of such process must be punishable. It is with such an objective, the Government of Kerala issued the notification under challenge, prescribing the standards and specifications for toddy, that it shall not contain foreign matters like starch. This notification is fully within the purport of rule 2 (n) of the Rules, and it is fully within the rule making powers of the Government under Section 29 (k) of the Act. Just because the clause (k) is not seen specifically worded the notification issued under Section 29 will not lose its value. This notification specifically shows that it is issued by the Government in exercise of the powers under Section 29 of the Act. When the notification shows that it is issued under Section 29 of the Act, in exercise of the rule making powers of the Government under Section 29, and when the subject of notification is clear, it has little consequence that clause (k) dealing with the particular subject is not specifically mentioned in the Government Order.

18. The petitioners mainly rely on the decision of the Hon'ble Supreme Court in

State of Kerala v. Unni [ 2007 (1) KLT 151 (SC)].

The question of law that came up for consideration before a Division Bench of this Court in State of Kerala v. Unni [2005 (1) KLT 714], was regarding the validity of Rule 9 (2) of the Rules as it stood prior to 2007 amendment, prescribing the permissible extent of ethyl alcohol in toddy. This Court held in the said case that Rule 9 (2) of the Rules fixing strength of ethyl alcohol in toddy is not arbitrary or unreasonable. The matter came up before the Hon'ble Supreme Court in State of Kerala v. Unni [ 2007 (1) KLT 151].

The Hon'ble Supreme Court held that Rule 9 (2) of the Rules fixing the permissible limit of ethyl alcohol in toddy is unworkable, vague and unreasonable. This decision of the Hon'ble Supreme Court cannot be applied in these cases for two reasons. One is that the matter under challenge in the said case was the validity of Rule 9 (2) of the Rule fixing the permissible limit of ethyl alcohol. What is under challenge in these proceedings is the amendment subsequently brought to Rule 9 (2) of the Rules fixing the specifications and standards of toddy. The Government Notification under challenge here, amending Rule 9 (2) of the Rules was issued after Unni's case was decided by the Hon'ble Supreme Court. This is the second reason. Thus, I find that Unni's case decided by the Hon'ble Supreme Court cannot be applied here.

In

Komalam v. State of Kerala [2009 (2) KLT 744]

a Division Bench of this Court held that prescribing the standards of liquor by making such prescriptions and specifications in accordance with the report of Indian Standard Institution can be taken as valid prescription made after proper scientific study. This Court also held that there is no conflict between the definition of Toddy under the Act and the Rules. In that case also, the main point decided was, the validity of Rule 9 (2) prescribing the permissible extent of ethyl alcohol prior to 2007 amendment. The question of adulteration by adding extraneous materials like starch did not come up for consideration in any of the cases, because such notification came only thereafter. However, the said question came up before a Single Bench of this Court in

Muraleedharan v. State of Kerala [2011 (1) KLT 886].

In that case, the validity of Rule 9 (2) read with Government Notification stipulating that nothing like starch shall be added to toddy to increase its quality or strength, or to alter its natural composition or for any other purpose, was considered by this Court. In the said case, this Court held that by relying on the decision in

Balu v. State of Kerala [ 2007 (1) KLT 401]

which was rendered prior to the amendment in 2007, it cannot be contended that the Government Notification or the Rules prohibiting addition of starch to toddy is invalid. The validity of the Government Notification under challenge, and the amendment made to Rule 9 (2) was upheld by this Court in Muraleedharan v. State of Kerala[2011 (1) KLT 886]. I fully agree with the learned Single Judge; I find that the Government Notification under challenge is not bad at all, that it is well within the powers of the Government under Rule 2 (n) of the Rules and I also find that the amendment brought to Rule 9 (2) of the Rules by the Government by notification is well within the rule making powers of the Government under Section 29 (k) of the Act. I find no reason or ground at all for any difference of opinion, or to disagree with the findings in Muraleedharan v. State of Kerala [2011 (1) KLT 886].

19. The object of Section 29 of the Kerala Abkari Act, authorising the Government to make rules by Government Notifications is that Government must be armed with such powers to meet change in social circumstances to control, regulate and govern the manufacture, supply, sale, possession etc of liquor to ensure public safety and health in enforcement of article 47 of the Constitution of India, and also to meet the challenges raised by liquor dealers and others in the process of manufacture, sale and transport of liquor. Clause (k) gives powers to the Government to prohibit the use of any article which the Government shall deem to be noxious or otherwise objectionable. The Government notification under challenge, amending Rule 9 (2) of the Rules was issued fully in exercise of the powers under clause (k) to Section 29 of the Act. Just because the clause (k) is not seen specifically mentioned in the Government Notification, it will not lose its validity or sanctity as Government Order having the force of law. Prohibiting the use of any article in the manufacture of liquor is the specific subject dealt with under clause (k). If that subject is dealt with under any Government order amending the particular Rule, the said Government Order can definitely be considered as one under clause (k) to Section 29 of the Act. Law cannot be mechanically interpreted and applied. Negligible infirmity or flaws can be ignored in the process of interpretation of law when the object of the law is unambiguous, and if the Rule made by the Government is to carry out or enforce the oubject. The objectionable SRO No.145 of 2007 dated 14.2.2007 prescribing the standards and specifications of toddy, that it shall be free from any added colouring, flavouring or sweetening or other foreign matter like starch, tranquilizers or sedatives or chloral hydrate is well within the powers granted under the amended Rule 9 (2) of the Rules. The amended rule now provides that adding anything to liquor to alter its natural composition or basic composition cannot in any circumstance be allowed, and to carry out this object, the Government can, by notification prohibit addition of any foreign matter including starch. Much thought is not required to find that if starch is added to toddy, it will alter its basic or natural composition, thereby increasing the quantity, and the result of such adulteration is that the dealer or the licensee will get unlawful profit or gain. It is to prevent this and other tactics in the manufacture and sale of liquor, the Government amended Rule 9 (2), and also issued a notification in terms of the amended Rule 9 (2), that toddy shall be free from starch. I find that the Government notifications under challenge are well within the powers of the Government, and I declare that the amended Rule 9 (2) of the Rules is not at all ultra vires the rule making powers of the Government under Section 29 (k) of the Act. Consequently, all these proceedings will have to be dismissed.

20. Some decisions cited by the petitioners are not being considered and discussed because those were rendered before the amendment brought to Rule 9 (2) of the Rules in 2007. The only decision on the point is that of a Single Bench of this Court in Muraleedharan v. State of Kerala [2011 (1) KLT 886], which I have already discussed.

21. Another ground set up by the petitioners in all the proceedings to challenge the sustainability of the prosecution is, that the report of chemical analysis relied on by the prosecution cannot at all be accepted as valid. Practically, they seek the benefit of the decision of the Hon'ble Supreme Court in

Pepsico India Holdings Pvt. Ltd v. Food Inspector and Another [2010 (4) KHC 767].

It is in fact idle to contend that persons facing prosecution under the Kerala Abkari Act can claim the benefit of Pepsico decision rendered by the Hon'ble Supreme Court under the Prevention of Food Adulteration Act, where the law prescribes that the Government shall notify the laboratories wherein food samples can be analysed. There is no such provision under the Kerala Abkari Act or the Rules that the Government shall prescribe or notify the laboratories wherein samples of liquor; be it toddy or arrack or foreign liquor, can be analysed to detect the nature of components and the percentage of components. In the Pepsico case, the Hon'ble Supreme Court held that the report of analysis given from the Regional Food Laboratory cannot be accepted as a basis for prosecution because the Government of India has not so far notified the laboratories as prescribed under the law. In these proceedings where the petitioners face prosecution under the Kerala Abkari Act, they cannot be heard to contend that they must also get the benefit of Pepsico decision. Report of chemical analysis issued from the Government laboratory will have to be accepted as legal and valid under Section 293 (1) of Cr.P.C when the Kerala Abkari Act does not contain any provision specifically, that the Government shall notify any laboratory or institution for examination of samples of liquor. Here, the subject and the object are different. So the benefit of the decision of the Hon'ble Supreme Court in Pepsico case cannot in any circumstance be extended to persons facing prosecution under the Kerala Abkari Act. Accordingly, I find that the prosecution under challenge in these proceedings cannot be quashed by way of writ of certiorari or under Section 482 of the Code of Criminal Procedure, on the ground that the Government laboratory, wherein, the samples of toddy were analysed, is not specifically notified by the Government under any law. When there is no such provision under the Kerala Abkari Act, or the Rules made thereunder, the situation must be governed by Section 293 (1) of the Code of Criminal Procedure. On the basis of the discussions and findings made above, I find that all these proceedings are liable to be dismissed.

The findings made are as follows:

(a) The amendment brought by the Government of Kerala to Rule 9 (2) of the Kerala Abkari Shops Disposal Rules, 2002 by way of Government notification issued in 2007 is well within the rule making powers of the Government under Section 29 (k) of the Abkari Act, and it is not ultra vires the rule making powers of the Government.

(b) The Government Notification G.O (P) No.25/2007/TD in S.R.O 145 of 2007 dated 14.2.2007 is also well within the powers of the Government under Rule 9 (2) and Rule 2 (n) of the Rules.

(c) The petitioners in these proceedings, as persons facing prosecutions under the Kerala Abkari Act, are not entitled to claim the benefit of the decision of the Hon'ble Supreme Court in Pepsico case.

(d) The prosecutions under challenge cannot be quashed by way of writ of certiorari or under Section 482 of the Code of Criminal Procedure, as sought by the petitioners.

(e) Disposal of these writ petitions and criminal miscellaneous cases will not prejudice the right of the petitioners to apply for discharge in the trial court on factual grounds, or on other legal grounds affecting the sustainability of the prosecution.

In the result all these writ petitions and Criminal Miscellaneous Cases are dismissed.