(2015) 393 KLW 072

IN THE HIGH COURT OF KERALA AT ERNAKULAM

PRESENT: THE HONOURABLE MR. JUSTICE P.B.SURESH KUMAR

TUESDAY,THE 3RD DAY OF FEBRUARY 2015/14TH MAGHA, 1936

MFA.(WCC)No. 209 of 2010

AGAINST THE ORDER IN WCC 169/2002 of W.C.C., KOZHIKODE

APPELLANT

M/S.NEW INDIA ASSURANCE CO.LTD., MUNICIPAL T.B.TELLICHERRY,REP.BY ITS MANAGER, THE NEW INDIA ASSURANCE COMPANY LTD., REGIONAL OFFICE, M.G.ROAD, ERNAKULAM.

BY ADV. SRI.LAL GEORGE

RESPONDENT(S)

1. MUHAMMED ALI

2. LAXMAN & CO. CONTRACTOR, TELLICHERRY 670 101.

3. RUBCO CHAPPAL FACTORY,VELIVELICHAM, KOOTHUPARAMBA 670 643.

R1 BY ADV. SRI.AVM.SALAHUDIN R3 BY ADV. SRI.C.P.MOHAMMED NIAS

JUDGMENT

The insurer in a proceedings for compensation before the Commissioner for Workmen's Compensation has come up in this appeal challenging the quantum of compensation granted to the workman in the proceedings.

2. The first respondent instituted the proceedings referred to above under

Section 22 of the Workmen's Compensation Act, 1923

(hereinafter referred to as "the Act" for short) claiming compensation for the personal injuries sustained by him. According to him, he sustained personal injuries by accident arising out of and in the course of his employment under the second respondent on 29.5.2001. He claimed a sum of Rs.2,00,000/- by way of compensation in the proceedings.

3. The Commissioner for Workmen's Compensation, on an evaluation of materials on record, found that the workman sustained injuries by accident arising out of and in the course of the employment under the second respondent. The Commissioner also found that the first respondent who sustained temporary disablement is entitled to compensation as provided for under Section 4(1)(d) of the Act. Even though the first respondent claimed that his monthly wages was Rs.7,000/-, in the absence of documentary proof, the Commissioner reckoned the monthly wages of the first respondent at Rs.5,000/- and determined the compensation payable to the first respondent under Section 4(1)(d) of the Act at Rs.22,500/-. The risks of the employer at the time of the accident was covered by an insurance policy issued by the appellant. Consequently, the Commissioner directed the appellant to deposit the compensation granted to the first respondent with interest as provided for in the Act. The appellant is aggrieved by the said order of the Commissioner and hence this appeal.

4. Heard Sri.Lal George, the learned counsel for the appellant and Sri.A.V.M.Salahudeen, the learned counsel for the first respondent.

5. The learned counsel for the appellant contended that in view of Explanation II to Section 4(1)(b) of the Act, while determining the compensation payable under Section 4(1)(d) of the Act, the monthly wages of the workman concerned can be reckoned only as Rs.4,000/-, and the Commissioner had determined the compensation payable to the first respondent by reckoning his monthly wages at Rs.5,000/-. According to him, the impugned order to that extent is illegal.

6. Per contra, the learned counsel for the first respondent contended that Explanation II to Section 4(1)(b) of the Act will not have any application while determining the compensation payable to a workman under Section 4(1)(d) of the Act for temporary disablement and therefore, the order of the Commissioner is perfectly in accordance with the Act.

7. The contention raised by the appellant involves interpretation of the provisions in Section 4 of the Act. It is beyond dispute that the Act is a piece of social security and welfare legislation intended to make the employer of the workmen responsible for the loss caused by injuries or death, arising out of and in the course of employment. It is, therefore, imperative for the courts to give a purposive interpretation of the provisions contained therein keeping in view of the directive principles of state policy embodied in Articles 38 and 43 of the Constitution of India. Section 4 of the Act reads thus :

(1) Subject to the provisions of this Act, the amount of compensation shall be as follows, namely:-

(a) Where death results from the injury an amount equal to (fifty per cent) of the monthly wages of the deceased workman multiplied by the relevant factor; or an amount of (eighty thousand rupees), whichever is more

(b) Where permanent total disablement result from the injury an amount equal to (sixty per cent of the monthly wages of the injured workman multiplied by the relevant factor; or an amount of (ninety thousand rupees), whichever is more;

Explanation I. For the purposes of clause (a) and clause (b), "relevant factor", in relation to a workman means the factor specified in the second column of Schedule IV against the entry in the first column of that Schedule specifying the number of years which are the same as the completed years of the age of the workman on his last birthday immediately preceding the date on which the compensation fell due.

Explanation II. Where the monthly wages of a workman exceed (four thousand rupees), his monthly wages for the purposes of clause (a) and clause (b) shall be deemed to be(four thousand rupees) only;

(c) Where permanent partial disablement result from the injury

(i) in the case of an injury specified in Part II of Schedule I, such percentage of the compensation which would have been payable in the case of permanent total disablement as is specified therein as being the percentage of the loss of earning capacity caused by that injury; and

(ii) in the case of an injury not specified in Schedule I, such percentage of the compensation payable in the case of permanent total disablement as is proportionate to the loss of earning capacity (as assessed by the qualified medical practitioner) permanently caused by the injury;

Explanation I.-Where more injuries than one are caused by the same accident, the amount of compensation payable under this head shall be aggregated but not so in any case as to exceed the amount which would have been payable if permanent total disablement had resulted from the injuries.

Explanation II.- In assessing the loss of earning capacity for the purpose of sub-clause (ii), the qualified medical practitioner shall have due regard to the percentages of loss of earning capacity in relation to different injuries specified in Schedule I;

((1-A) Notwithstanding anything contained in subsection (1), while fixing the amount of compensation payable to a workman in respect of an accident occurred outside India, the Commissioner shall take into account the amount of compensation, if any, awarded to such workman in accordance with the law of the country in which the accident occurred and shall reduce the amount fixed by him by the amount of compensation awarded to the workman in accordance with the law of that country.)

(2) The half-monthly payment referred to in clause (d) of sub- section (1) shall be payable on the sixteenth day-

(i) from the date of disablement where such disablement lasts for a period of twenty-eight days or more, or

(ii) after the expiry of a waiting period of three days from the date of disablement where such disablement lasts for a period of less than twenty-eight days; and thereafter half-monthly during the disablement or during a period of five years, whichever period is shorter:

Provided that- (a) there shall be deducted from any lump sum or half-monthly payments to which the workman is entitled the amount of any payment or allowance which the workman has received from the employer by way of compensation during the period of disablement prior to the receipt of such lump sum or of the first half-monthly payment, as the case may be; and

(b) no half-monthly payment shall in any case exceed the amount, if any, by which half the amount of the monthly wages of the workman before the accident exceeds half the amount of such wages which he is earning after the accident.

Explanation.--Any payment or allowance which the workman has received from the employer towards his medical treatment shall not be deemed to be a payment or allowance received by him by way of compensation within the meaning of clause (a) of the proviso.

(3) On the ceasing of the disablement before the date on which any half-monthly payment falls due there shall be payable in respect of that half-month a sum proportionate to the duration of the disablement in that half-month.)

((4) If the injury of the workman results in his death, the employer shall, in addition to the compensation under sub-section (1), deposit with the Commissioner a sum of (two thousand and five hundred rupees) for payment of the same to the eldest surviving dependant of the workman towards the expenditure of the funeral of such workman or where the workman did not have a dependant or was not living with his dependant at the time of his death to the person who actually incurred such expenditure.)"

As is evident from Section 4 of the Act, Explanation II referred to by the learned counsel for the appellant is an Explanation to clause (b) to Section 4(1) of the Act. The said Explanation provides that where the monthly wages of a workman exceed four thousand rupees, his monthly wages for the purposes of clause (a) and clause (b) shall be deemed to be four thousand rupees only. It is settled that an explanation added to a statutory provision is not a substantive provision, but only meant to explain or clarify the ambiguities which may arise. The explanation, therefore, does not enlarge the scope of the provision which it explains, but only makes its meaning clear beyond dispute.

[See

S. Sundaram Pillai v. V. R. Pattabiraman (AIR 1985 SC 582)

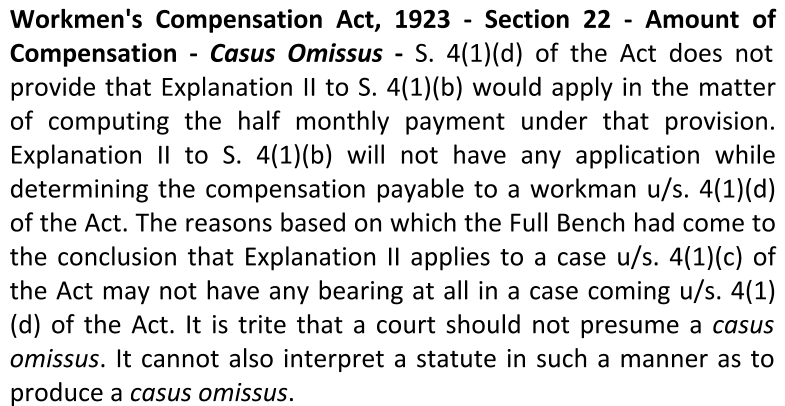

If the explanation referred to above is understood in the light of the said principles, it is clear that the same is intended only for the purposes of determining the compensation payable under clause (a) and clause (b) of Section 4 (1) of the Act. Section 4(1)(d) of the Act does not provide that Explanation II to Section 4(1)(b) would apply in the matter of computing the half monthly payment under that provision. It is trite that a court should not presume a casus omissus. It cannot also interpret a statute in such a manner as to produce a casus omissus.

(See

Uco Bank v. Rajinder Lal Capoor (2008) 5 SCC 257

and

State of Karnataka v. Union of India (1977) 4 SCC 608]

It is thus clear that Explanation II referred to by the learned counsel will not have any application while determining the compensation payable to a workman under Section 4(1)(d) of the Act.

8. The learned counsel for the appellant submitted that the issue whether Explanation II to Section 4(1)(b) of the Act would apply while determining the compensation payable to a workman under Section 4(1)(c) of the Act came up for consideration before a Full Bench of this Court in