(2015) 392 KLW 981

IN THE HIGH COURT OF KERALA AT ERNAKULAM

PRESENT: THE HONOURABLE MR. JUSTICE A.K.JAYASANKARAN NAMBIAR

WEDNESDAY, THE 4TH DAY OF FEBRUARY 2015/15TH MAGHA, 1936

W.P.(C).NOS.22299, 22304, 22357, 35546, 35555 & 35556 OF 2014 & W.P.(C).NOS.10, 34, 35, 38, 39, 40, 61, 62, 63, 66, 85, 110, 343, 344, 345, 351, 352, 353, 376, 383, 413, 535, 543, 544, 545, 551, 552, 553, 725, 726, 727, 731, 738, 739, 845, 846, 847, 848, 849, 895, 896, 897 & 1710 OF 2015

PETITIONER(S)

1. FR.SABU P.THOMAS, LOYOLA COLLEGE OF SOCIAL SCIENCE, SREEKARIAM, THIRUVANANTHAPURAM.

2. KERALA JESUIT SOCIETY, CHRIST HALL, MALAPPARAMBA, CALICUT - 673 009, REPRESENTED BY IT'S SECRETARY & TRAEASURER FR. PETER MULLUPARAMPIL.

BY ADV. SRI.A.KUMAR

RESPONDENT(S)

1. UNION OF INDIA, REPRESENTED BY SECRETARY, MINISTRY OF FINANCE, NORTH BLOCK, NEW DELHI - 110 001.

2. CENTRAL BOARD OF DIRECT TAXES, REPRESENTED BY SECRETARY, MINISTRY OF FINANCE, NORTH BLOCK, NEW DELHI - 110 001.

3. THE COMMISSIONER OF INCOME TAX (TDS), CENTRAL REVENUE BUILDING, I S PRESS ROAD, COCHI - 682 018.

4. INCOME TAX OFFICER (TDS), OFFICE OF THE JOINT COMMISSIONER OF INCOME TAX (TDS), AYAKAR BHAVAN, KAUDIAR, THIRUVANANTHAPURAM - 3.

5. JOINT COMMISSIONER OF INCOME TAX (TDS), AYAKAR BHAVAN, KAUDIAR, THIRUVANANTHAPURAM -3.

6. DEPUTY DIRECTOR OF COLLEGIATE EDUCATION, KOLLAM - 691 001.

7. SUB TREASURY OFFICER, VANCHIYOOR, THIRUVANANTHAPURAM - 695 001.

R1 TO R 5 BY ADV. SRI.P.K.RAVINDRANATHA MENON, SENIOR SC SRI.JOSE JOSEPH, SC R6 & R7 BY GOVERNMENT PLEADER SRI.SHYSON P.MANGUZHA

J U D G M E N T

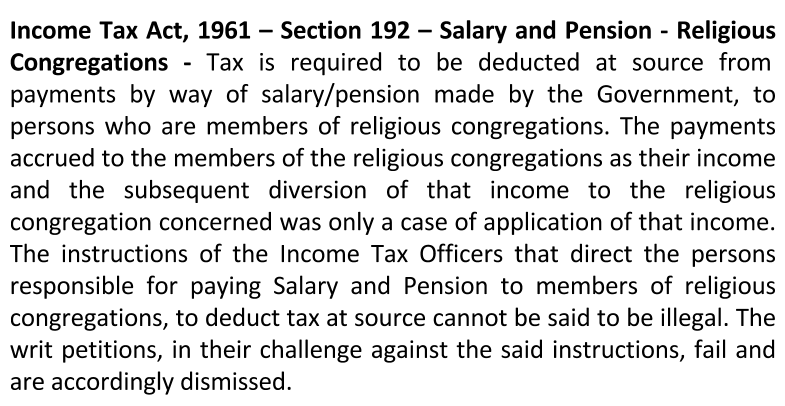

The short question that arises in all these writ petitions is whether, under the Income Tax Act, tax is required to be deducted at source, from payments by way of salary/pension made by the Government, to persons who are members of religious congregations.

The writ petitions were filed in the wake of instructions, issued by the Income Tax authorities to the District Treasury Officers in the State, calling upon them to deduct tax at source from such payments made to members of religious congregations. While in most of the writ petitions, the religious congregation concerned is the petitioner, in W.P.(C).No.10/2015, an individual member of the religious congregation is the petitioner.

2. The brief facts necessary for a disposal of these writ petitions is as follows: The members of the religious congregations concerned are employed as teachers in various aided educational institutions in the State. The remuneration that they draw, for the teaching services rendered by them, is in the nature of salary that is paid to them by the State Government. In one case, the payment made is of pension, subsequent to the retirement of the member from service. The payments are made to them through the educational institution in question pursuant to a disbursal of the amounts through the Government Treasury. The issue as to whether or not the amounts by way of fees or earnings, received by the members of the religious congregation, would be treated as income in their hands, had engaged the attention of the Central Board of Direct Taxes as early as in 1944, when it was clarified that fees and other earnings of missionaries, that they were obliged to make over to the congregation to which they belonged, would not be treated as income in their hands but viewed as diverted by overriding title to the congregation of which they were a part. While the said Circular of 1944, and the subsequent Instructions of 1977, are said to be in force even today, the respondent authorities began to issue instructions to the District Treasury Officers in the State, to deduct tax at source from payments, by way of salary and pension, made to members of religious congregations. The said instructions are impugned in the writ petitions inter alia on the grounds that (i) they run counter to the instructions of the Central Board of Direct Taxes, issued in terms of Section 119 of the IT Act, that are binding on all authorities under the IT Act and (ii) they run counter to the well accepted legal position that members of religious congregations cannot own property, and whatever amounts are received by them towards earnings is diverted by overriding title to the congregation and forms part of the latter's income.

3. A statement has been filed on behalf of the respondents, wherein the stand taken is that the instructions issued by the CBDT in 1977, dealt only with fees and not with salary income and hence, in respect of salary income, there was no binding instruction of the CBDT that held the field. It is also pointed out that, insofar as the members of the religious congregations were receiving the income in return for services rendered by them, the salary income had accrued to them, and the subsequent making over to the congregation was only an instance of application of income. The instructions issued to the District Treasury Offices are sought to be justified on the said basis.

4. I have heard learned Senior Counsel Sri.Kurien George Kannanthanam, as well as Sri.A.Kumar and Sri.K.T.Thomas on behalf of the petitioners and the learned Senior Counsel Sri. P.K.Ravindranath Menon for the Income Tax department.

5. The submissions of learned counsel for the petitioners can be summarised as follows:

- The Central Board of Direct Taxes had, by its Circular dated 24.01.1944, followed by its Instructions dated 05.12.1977, clearly indicated that, in so far as the fees and other earnings received by the missionaries are to be made over to the congregation concerned, there is an overriding title to fees which would entitle the missionaries to exemption from payment of tax and consequently, such fees or earnings would not be taxable in their hands. The said Circular and instructions of the CBDT were binding on the Income Tax authorities under the IT Act by virtue of S. 119 of the IT Act. It followed, therefore, that an Income Tax Officer could not have issued instructions to deduct tax at source from salary payments that were effected from the Government to members of religious congregations. The decisions of the Supreme Court in R & B Falcon (A) Pvt. Limited v. Commissioner of Income Tax - [(2008) 12 SCC 466], State of Tamil Nadu and Another v. India Cements Limited and Another - [(2011) 13 SCC 247] and Commissioner of Central Excise v. Ratan Melting & Wire Industries - [(2008) 13 SCC 1] are relied upon to substantiate the contention that instructions and Circulars of the CBDT are binding upon the authorities under the IT Act.

- As regards the contents of the Circular/Instructions issued by the CBDT, it is pointed out that it applies to all receipts by way of fees and earnings, that is received by a member of the religious congregation who is obliged, under the precepts of canon law, to make over the said receipts to the religious congregation. It is pointed out that as per Canon Law, the member of the religious congregation cannot own any property and whatever he/she receives is a receipt on behalf of the religious congregation of which he/she is a member. In support of this contention, reliance is placed on the decisions of this Court in Mother Superior, Adoration Convent, Kanjiramattom v. D.E.O., Kottayam & Others - [1977 KLT 303], Oriental Insurance Co. v. Mother Superior S.H. Convent - [1994 (1) KLT 868] and Varghese v. Krishnan Nair - [2004 (2) KLT 783].

- On the issue of whether or not there is a diversion of income by overriding title, it is contended that, on account of the pre-existing obligation of the member of the religious congregation, based on the precepts of Canon Law, the member was incapable of receiving any amount from the Government by way of salary or pension and consequently, such receipts had to be deemed as having accrued to the religious congregation concerned by applying the principle of diversion of income by overriding title. It is contended that these are not instances of application of income by the member of the religious congregation since the income never reached the member of the religious congregation at all. Reliance is placed on the following decisions in support of the said contention; Commissioner of Income Tax v. A. Gajapathy Naidu - [AIR 1964 SC 1653], CIT v. Ashokbhai Chimanbhai - [AIR 1965 SC 1343], E.D. Sassoon & Co. Ltd. v. Commissioner of Income Tax - [26 ITR 27 (SC)], Motilal Chhadami Lal v. Commissioner of Income Tax - [190 ITR 1 (SC)], P.C.Mullick & Another v. Commissioner of Income Tax - [6 ITR 206 (PC)], Commissioner of Income Tax v. Sitaldas Tirathdas - [41 ITR 367 (SC)], Commissioner of Income Tax v. Surat Jilla Kamdar Sahakari Sangh - [201 ITR 157 (Guj)], Additional Commissioner of Income Tax v. Rani Pritam Kunwar - [125 ITR 102 (All)], Commissioner of Income Tax v. Subramaniam Bros. - [236 ITR 148 (Mad)], Surajratan Damani v. Commissioner of Income Tax - [106 ITR 576 (Bom)] and Commissioner of Income Tax v. Sunil J. Kinariwala - [2003 (1) SCC 660].

6. Per Contra, the submissions of the learned Senior Counsel appearing on behalf of the revenue in these cases, briefly put, is as follows:

- The Circular dated 24.01.1944 of the CBDT, as well as the instructions dated 05.12.1977, refer only to fees and other income earned by "missionaries", and not to all members of religious congregations. It is contended that the term "missionaries" would apply only to those engaged in the dissemination of religious knowledge, and not to members of a religious congregation engaged in general vocations, including the teaching profession. The Circular could not, therefore, be treated as having universal application to all cases of receipts, by way of fees or other earnings, of members of religious congregations.

- It is pointed out that the nature of the receipts, in the instant cases, would have to be looked into to determine whether they constituted the income of the member of the religious congregation who received it. It is contended that, insofar as the receipts were by way of salary and pension, and were payments made to the recipients for services rendered by them in their individual capacities, the said payments accrued to the recipients as their income and the subsequent diversion to the religious congregation was only an instance of application of that income.

- Referring to the decisions in Mother Superior, Adoration Convent, Kanjiramattom v. D.E.O., Kottayam & Others - [1977 KLT 303], Oriental Insurance Co. v. Mother Superior S.H. Convent - [1994 (1) KLT 868] and Varghese v. Krishnan Nair - [2004 (2) KLT 783], it is contended that the said decisions only decided the inter se relationship between the religious congregation and its members, and the manner in which amounts becoming due to a member, would be applied in the event of the death of the member. The said decisions could not, therefore, have a bearing on the issue to be decided in the instant cases. It is further contended that, the said decisions only interpreted the rights of a member of the religious congregation under personal law and could not be relied upon for determining his/her obligations under the IT Act.

- Lastly, it is contended that the receipts in the instant cases, constituted the income of the member of the religious congregation who received it and, consequently, there was nothing illegal or irregular in the instructions issued by the Income Tax Officer to the Treasury Officers, to deduct tax at source under Section 192, from payments by way of salary and pension to members of the religious congregations. It is contended that the payments by the members to the religious congregation, of amounts received by them by way of salary or pension, could be viewed only as an application of income by the member concerned, for the purposes of the IT Act.

7. On a consideration of the facts and circumstances of the case and the submissions made across the bar, I find that the primary issue to be decided in the instant cases is whether there is a diversion of income by overriding title to the religious congregation, in every case where one of its members receives amounts by way of salary/pension for services rendered by him/her. The significance of the issue, in the context of the Income Tax Act, becomes apparent when one considers two fundamental concepts in Income Tax Law, namely, (i) Diversion of income by overriding title and (ii) Application of income. In the former, the income that is diverted at source is not liable to tax in the hands of the assessee, and in the latter, the transaction is ignored and the assessee in whose hands the income accrues becomes liable to tax. The test to be applied is to see whether the amount in question ever reached the assessee as his/her income. Under the IT Act, every income that accrues or arises is liable to be taxed, irrespective of what happened to it afterwards. If, however, the income does not reach the assessee but, on account of a legal obligation, is diverted before it reaches him/her, then he/she cannot be taxed on such income. A classic statement of the law is to be found in the judgment of the Supreme Court in

Commissioner of Income Tax v. Sitaldas Tirathdas - [1961 (41) ITR 367 (SC)]

where the principle was succinctly stated as follows:

"These are the cases which have considered the problem from various angles. Some of them appear to have applied the principle correctly and some, not. But we do not propose to examine the correctness of the decisions in the light of the facts in them. In our opinion, the true test is whether the amount sought to be deducted, in truth, never reached the assessee as his income. Obligations, no doubt, there are in every case, but it is the nature of the obligation which is the decisive fact. There is a difference between an amount which a person is obliged to apply out of his income and an amount which by the nature of the obligation cannot be said to be a part of the income of the assessee. Where by the obligation income is diverted before it reaches the assessee, it is deductible; but where the income is required to be applied to discharge an obligation after such income reaches the assessee, the same consequence, in law, does not follow. It is the first kind of payment which can truly be excused and not the second. The second payment is merely an obligation to pay another a portion of one's own income, which has been received and is since applied. The first is a case in which the income never reaches the assessee, who even if he were to collect it, does so, not as part of his income, but for and on behalf of the person to whom it is payable. In our opinion, the present case is one in which the wife and children of the assessee who continued to be members of the family received a portion of the income of the assessee, after the assessee had received the income as his own. The case is one of application of a portion of the income to discharge an obligation and not a case in which by an overriding charge the assessee became only a collector of another's income."

8. In the case of the members of the religious orders in these writ petitions, they are bound by the precepts of Canon Law that oblige them to observe the vows of Chastity, Obedience and Poverty prior to their ordainment as members of the congregation. Canon 668 in the Code of Canon Laws reads as follows: Can. 668

'1 Before their first profession, members are to cede the administration of their goods to whomsoever they wish and, unless the constitutions provide otherwise, they are freely to make dispositions concerning the use and enjoyment of their goods. At least before perpetual profession they are to make a will which is valid also in civil law.

'2 To change these dispositions for a just reason, and to take any action concerning temporal goods, there is required the permission of the Superior who is competent in accordance with the institute's own law.

'3 Whatever a religious acquires by personal labour, or on behalf of the institute, belongs to the institute. Whatever comes to a religious in any way through pension, grant or insurance also passes to the institute, unless the institute's own law decrees otherwise.

'4 When the nature of an institute requires members to renounce their goods totally, this renunciation is to be made before perpetual profession and, as far as possible, in a form that is valid also in civil law; it shall come into effect from the day of profession. The same procedure is to be followed by a perpetually professed religious who, in accordance with the norms of the institute's own law and with the permission of the Supreme Moderator, wishes to renounce goods in whole or in part.

'5 Professed religious who, because of the nature of their institute, totally renounce their goods, lose the capacity to acquire and possess goods; actions of theirs contrary to the vow of poverty are, therefore, invalid. Whatever they acquire after renunciation belongs to the institute in accordance with the institute's own law.

9. The legal consequences that ensue from an adoption of the religious way of life have been discussed in a Division Bench decision of this Court in

Mother Superior, Adoration Convent, Kanjiramattom v. D.E.O, Kottayam and Ors - [1977 KLT 303]

The said case considered the issue of whether the head of a religious congregation could be validly nominated as a member of the family of a deceased nun, for the purposes of receiving the gratuity that was payable to the nun. As per the provisions of the Kerala Service Rules, as they then stood, the definition of the term "family" for the purposes of nomination, included only certain natural relatives and not the head of the religious congregation, of which the nun was a member. This Court considered the formalities that are undergone by a person who takes to the religious profession among the Catholics and found as follows:

"4. As a preliminary to the question arising for consideration it is necessary to describe the formalities that are gone through by a person who takes to the religious profession among the Catholics. Catholic Encyclopedia, Vol. 12, page 287, describes what is meant by a religious life. It is described as a particular expression of the love of God through a following of Christ. It is approved by the Church as a public state of life by the profession of poverty, chastity and obedience through public vows and by some form of separation from the world, practised for the sake and service of the world Religious profession is an act by which a person embraces the religious state by taking the three public vows of poverty, chastity and obedience. This is really an agreement made with the religious order which, when accepted by the competent superior, creates a whole series of reciprocal rights and obligations between the religious order and the religious. Before a person is admitted into this order he or she is put on probation. "Postulantship" is intended to give the superiors an opportunity to observe the candidate and the candidate an opportunity of becoming acquainted with the general obligations of the religious life. After the period of this probation the candidate is admitted to the novitiate. Thereafter she is put to a Canonical examination to make certain that she is acting with full knowledge of the case and with full liberty. If she gets through the examination she is required to take a temporary vow which is generally for a period of three years. During this period the superior will judge the fitness of the person to take the perpetual vow. After the expiry of the period of three years the religious shall either make his or her perpetual profession or he or she can return to the world. Before the perpetual vow is taken the professed must renounce in favour of the person whom he or she likes, all the property which he or she actually possesses on condition however of his solemn profession subsequently taking place. After the solemn profession is taken all property which may come to the religious in any manner whatsoever accrues to the Order according to the constitution and if the Order cannot acquire or own any property it becomes the property of the Holy See. The effect of taking a perpetual vow and becoming a nun is described thus in Pollock and Maitland's History of English Law, Vol. I, page 434:-

"A monk or nun cannot acquire or have any proprietary rights. When a man becomes `professed in religion', his heir at once inherits from him any land that he has, and, if he has made a will, it takes effect at once as though he were naturally dead. If after this a kinsman of his dies leaving land which according to the ordinary rules of inheritance would descend to him, he is overlooked as though he were no longer in the land of the living; the inheritance misses him and passes to some more distant relative. The rule is not that what descends to him belongs to the house of which he is an inmate; nothing descends to him for he is already dead. In the eye of ecclesiastical law the monk who became a proprietaries, the monk, that is, who arrogated to himself any proprietary rights or the separate enjoyment of any wealth, committed about as bad an offence as he could commit."

This fiction however has its own limits. If a monk or nun does wrong or suffers wrong he or she is dealt with as though he were only an ordained clerk and tried by the ordinary courts. In respect of civil wrongs the rule is that the monk or nun could neither sue nor be sued without his or her sovereign. A monk or nun could make no contract. But he or she is capable of acting as the agent of his or her sovereign and even in litigation he or she could appear as the superior's attorney. In the History of French Private Law included in the Continental Legal History Series, Vol. III, para 583, it is stated thus:

"Entering Religious Orders resulted in the eyes of the Church in death to the world. From this it should have been concluded that from the time of his entrance into a monastery the monk could not acquire anything, and that the possessions which he had at that time should pass to his heirs."

Thereafter the personality of the monk was absorbed by that of the monastery. He acted as a means of receiving for the benefit of the monastery. Once he had entered a monastery, the monk, stripping off his own personality, could only receive for the benefit of his community. But the monastery did not take those possessions which h had at the time of his entering it; he was regarded as being dead at that time and from this fiction there arose two consequences: 1st, his inheritance vested for the benefit of his relatives; 2nd, he was thence forward incapable of inheriting upon intestacy or by virtue of a will, either in his own interest or in the interest of the monastery. In this sense the civil death with which he was affected was the equivalent of real death. Similarly, in History of Italian Law included in the Continental Legal History Series, Vol. VIII, at page 512, para 299, it is stated thus:

"A sort of civil death overtook one who took solemn religious vows, though limited in its effect to property and inheritance."

Again, in Catholic Encyclopedia, page 32) the legal effects on taking to a religious profession as set forth in the Canon Law are stated with reference to those who take temporary vows and who take the perpetual vow. It is stated at page 330 that any `religious' in simple minor vows, must before joining the profession make a will disposing of all his or her property and cannot retain any property which later comes to them. It automatically becomes the property of the Order to which he or she belongs. This principle was followed in

to describe the status of a Sanyasi under Hindu Law also. In the case of a Sanyasi entrance to a religious Order generally operates as a civil death The man who becomes an ascetic severs his connection with the members of his natural family and being adopted by his preceptor becomes, so to say, a spiritual son of the latter In

Justice Mukherjea stated the law thus at page 613, para 20:

"It is well known that entrance into a religious order generally operates as a civil death. The man who becomes an ascetic severs his connection with the members of his natural family and being adopted by his preceptor becomes, so to say, a spiritual son of the latter. The other disciples of his Guru are regarded as his brothers, while the co-disciples of his Guru are looked upon as uncles and in this way a spiritual family is established on the analogy of a natural family."

10. It was accordingly held that, notwithstanding that the rules did not expressly provide for a nomination of the head of the religious congregation, there was no impediment to the deceased nun having made such a nomination. The above decision was followed in a later decision of this Court in

Oriental Insurance Co. v. Mother Superior S.H. Convent - [1994 (1) KLT 868]

where it was held that the Mother Superior of a Holy Order of Catholic nuns is the legal representative of a deceased nun of that congregation and was entitled to claim compensation on account of the death of the nun. The relevant portion of the judgment of the Division Bench is at paragraph 9 and reads as follows:

"9. Therefore, even though the deceased continued to be an Indian Christian as defined under S.2(d) of the Succession Act, because of her civil death by becoming a member of the Holy Order the natural heirs mentioned in Ss.41 to 48 of the Succession Act will not be her legal heirs. I f she had made a will it was to take effect at once as though she were naturally dead. So also if one of her kinsman dies leaving properties which according to-ordinary rules of inheritance would descend to her, she will be overlooked as though she were no longer alive. Entering religious orders resulted in the eyes of the Church in death to the world. From the time of her entrance into the Holy Order she could not acquire anything and she acted only as a means of receiving for the benefit of the Holy Order. By becoming a member of the Holy Order she becomes a member of the family consisting of the Mother Superior and other members of that Holy Order. Therefore, the contention of the learned counsel for the appellant that in view of S.29(2) of the Indian Succession Act, Ss.41 to 48 of the said Act should apply in this case also, cannot be accepted."

11. The upshot of the discussion in the aforementioned cases, which dealt with the receipt of amounts due to deceased members of religious congregations, is that a payment received by a member of a religious congregation of Catholics, is to be seen as a payment received for the benefit of the Holy Order. In other words, the said cases dealt with the issue of what had to be done with amounts that accrued to a member of the religious congregation, after her death. In was in that context, that the obligation of the member vis-`-vis the congregation, based on the precepts of Canon Law, were analysed and applied. The said cases did not have to consider the issue of whether, at first instance, the amounts ever reached the member or accrued to him/her. In the instant cases, the question to be considered is precisely that: whether, notwithstanding the obligation of a member of the religious congregation to make over any amount, received by him/her by way of remuneration or other earnings, to the congregation concerned, the amount could be treated as having accrued to him/her for the purposes of the Income Tax Act? As already noted, under the IT Act, every income that accrues or arises is liable to be taxed, irrespective of what happened to it afterwards. If, however, the income does not reach the assessee or accrue to him/her but, on account of a pre-existing legal obligation, is diverted before it reaches him/her, then the assessee cannot be taxed on such income. The test, though stated in simple terms, is often difficult in its application. It would be profitable, therefore, to refer to the following decisions to understand where the line of separation lies, between cases of diversion of income by overriding title and cases of application of income.

12. In

K.A.Ramachar v. Commissioner of Income Tax - [1961 (42) ITR 25 (SC)]

an assessee who was a partner of a firm settled a share of his profits in the firm on his wife, married daughter and a minor daughter. They were entitled to receive and collect their share from the firm under the settlement. Rejecting the contention of the assessee that the amounts covered by the settlement could not be included in his total income, the Supreme Court applied the principle laid down in Sitaldas Tirathdas (Supra) and held that, under the law of partnership, it was the partner and the partner alone who was entitled to the profits and that a stranger, even if he were an assignee, did not have and could not have any direct claim to the profits. The claim of the assessee was negatived on the ground that what was paid was in law a portion of his income and hence the amounts had to be included in his total income.

13. In

Murlidhar Himatsingka v. Commissioner of Income Tax - [1966 (62) ITR 323 (SC)]

one of the partners of the firm constituted a sub-partnership firm with his two sons and a grandson. The deed of sub-partnership provided that the profits and losses of the partner in the main firm shall belong to the sub-partnership and shall be borne and divided in accordance with the shares specified therein. The question in that case was: whether the share of the partner in the main firm, who had become a partner in the sub-partnership, could be assessed in his individual assessment. It was held that there was a overriding obligation which converted the income of the partner in the main firm in to the income of the sub-partnership and, therefore, the income attributable to the share of the partner had to be included in the assessment of the sub-partnership. That was on the principle that a partner in the sub-partnership had a definite enforceable right to claim a share in the profits accrued to or received by the other partner in the main partnership, as on entering into a sub-partnership, such a partner changes his character vis-a-vis the sub-partners and the Income Tax Authorities. Further, a sub-partnership creates a superior title and results in diversion of the income from the main firm to the sub-partnership before the same becomes the income of the partner concerned. In such a case, even if the partner receives the income from the main partnership, he does so not on his behalf but on behalf of the sub-partnership. Distinguishing K.A.Ramachar it was observed: (ITR p.332)

"In that case it was neither urged nor found that a sub-partnership came into existence between the assessee who was a partner in a firm and his wife, married daughter and minor daughter. It was a pure case of assignment of profits (and not losses) by the partner during the period of eight years. Further the fact that a sub-partner can have no direct claim to the profits vis-a-vis the other partners of the firm and that it is the partner alone who is entitled to profits vis-a-vis the other partners does not show that the changed character of the partner should not be taken into consideration for income tax purposes."

14. In

Commissioner of Income Tax v. Sunil J. Kinariwala - [(2003) 1 SCC 660]

the assessee, who was a partner of a firm holding ten per cent share therein, settled fifty percent of his ten percent right, title and interest (excluding capital), as a partner in the firm, and a sum of rupee five thousand out of his capital in the firm, in favour of a trust that he had created and of which the assessee's brother's wife, niece, and mother were the beneficiaries. While rejecting the contention of the assessee that the amounts transferred to the trust could not be included in his total income, the court found that the determinative factor is the nature and effect of the assessee's obligation in regard to the amount in question. When a third person becomes entitled to receive the amount under an obligation of an assessee even before he could lay a claim to receive it as his income, there would be a diversion of income by overriding title; but when after receipt of the income by the assessee, the same is passed on to a third person in discharge of the obligation of the assessee, it will be a case of application of income by the assessee and not of diversion of income by overriding title. Commenting on the distinction between the factual situation that arose in K.A.Ramachar (Supra) and Murlidhar Himatsingka (Supra), it was observed as follows:

"17. It is apt to notice that there is a clear distinction between a case where a partner of a firm assigns his share in favour of a third person and a case where a partner constitutes a sub-partnership with his share in the main partnership. Whereas in the former case, in view of Section 29(1) of the Indian Partnership Act, the assignee gets no right or interest in the main partnership, except, of course, to receive that part of the profits of the firm referable to the assignment and to the assets in the event of dissolution of the firm, but in the latter case, the sub-partnership acquires a special interest in the main partnership. The case on hand cannot be treated as one of a sub-partnership, though in view of Section 29(1) of the Indian Partnership Act, the Trust, as an assignee, becomes entitled to receive the assigned share in the profits from the firm not as a sub-partner because no sub-partnership came into existence but as an assignee of the share of income of the assigner-partner."

15. In

S.Venugopala Varma Rajah v. CIT, Trivandrum - [1968 (68) ITR 83 (Ker)]

a Full Bench of this Court considered the issue of whether the income derived by a tarwad, from properties that were in possession of junior members of the tarwad, based on an agreement (Karar) that was entered into among the members of the tarwad, could be treated as having been diverted by overriding title to the junior members for whose benefit the income was to be applied. It was held that the case was one where the tarwad received the income from the properties allotted to the junior members and applied the same for the purposes of the tarwad and not a case of diversion of income. There was no transfer of the properties from the tarwad to the allottees. The junior members of the tarwad had a right to be maintained out of the income from the properties of the tarwad, and the arrangement in the Karar was only a method for discharging the obligation of the tarwad in the matter of payment of maintenance to the junior members. The members received the income from the properties allotted, in their capacity as members of the tarwad and in discharge of the obligation of the tarwad to maintain them. Even assuming that the Karar was a settlement or disposition of the income, it was a case of application of the income of the tarwad, even though the assessee had entered into a legal obligation to apply it in that way. The decision of the Full Bench of this Court was affirmed by the Supreme Court in

V.Venugopala Varma Rajah v. CIT, Trivandrum - [1972 (84) ITR 466 (SC)]

The Supreme Court, while dealing with the contention of the assessee that the income in dispute never reached his hands, observed;

"the income of the family reached the hands of any of the members of the family who were entitled to receive it on behalf of the family. The members of the family received that income on behalf of the family, and applied the same in discharge of an obligation of the family. When this court spoke of the income reaching the hands of the assessee, it did not refer to any physical act. It was dealing with a legal concept - a receipt in law. Viewed that way, it is quite clear that the income with which we are concerned in this case was received by the family."

16. In the light of the principles that can be culled out from the decisions referred to above, I am of the view that for the concept of diversion of income by overriding title to apply, the diversion of income must be effective at the stage when the amount in question leaves the source, on its way to the intended recipient. At that stage, on account of a pre-existing legal obligation, the amount should be diverted to another, who can claim it as of right, based on the pre- existing legal arrangement. The person to whom the amount is diverted should have a legal right that entitles him to claim the amount directly from the source, and without the intervention of the person who would have received the amount but for the said legal arrangement. Viewed from that angle, the nature of the receipt would also have a bearing on the issue of whether the amount in question reached the member of the congregation or was diverted to the congregation, without reaching the member, by way of overriding title. The receipts in question, in the instant cases, are amounts by way of salary and pension. These payments accrue to the individuals concerned, who have rendered service in their individual capacity and based on the educational qualifications and skills possessed by them as individuals. The right to receive payments by way of salary or pension also, consequently, accrues or arises to them as individuals and not to the congregation of which they are members. No doubt, the precepts of Canon Law might require them to entrust the amounts so received to the religious congregation of which they form a part, but in my view the said obligation of the member, which is only an obligation based on personal law, would not clothe the religious congregation with a legal right to receive salary/pension payments directly from the Government/Employer, and without involving the member. Consequently, the entrustment of the amounts received by the member, to the congregation, would tantamount only to an application of income by the member in favour of the congregation. It will not be a case of diversion of income by way of overriding title.

17. I must now deal with the contention of the petitioners with regard to the Circular issued by the CBDT, that allegedly obliges the authorities under the IT Act to treat all receipts by way of earnings of members of religious congregations as the income of the religious congregation and not as the income of the individual member. The Instruction dated 05.12.1977, which is based on an earlier Circular dated 24.01.1944 of the CBDT, reads as under:

F.No.200/88/75-II)AI

GOVERNMENT OF INDIA

CENTRAL BOARD OF DIRECT TAXES

NEW DELHI: Dated the 5th Dec. 1977

To

All Commissioners of Income-tax.

Sir,

Subject : Exemption from payment of Income-tax on salaries of members of religious congregations.

___________

Attention is invited to Circular No.1 of 1944 O.No.26(43)- II/45, dated 24.1.1944 in which the liability to tax on the fees received by Missionaries and subsequently made over to the society had been considered.

2. Representations have been received from the members of religious congregations situated all over the country regarding the taxability of the fees received by them. The question for consideration, is whether the fees of the other earnings of the missionaries be assessed as their income, although the same is to be made over to the congregation to which they belong under the rules thereof.

3. The Board have examined this issue and have decided that since the fees recieved by the missionaries are to be made ever to the congregation concerned there is an over-riding title to fees which would entitle the missionaries to exemption from payments of tax. Hence such fees or earnings are not taxable in their hands.

4. Those instructions may be brought to the notice of all the officers working in your charge.

Yours faithfully,

Sd/- (J.P.Sharma) Secretary,

Central Board of Direct Taxes

18. It is no doubt true, that by virtue of Section 119 of the IT Act, Circulars and Instructions issued by the CBDT are binding on the authorities under the IT Act. The said provision under the IT Act is intended to ensure uniformity in the application of the law, by those who are entrusted with its administration across the Country. An officer under the IT Act is thus expected to conform to the Circulars and Instructions issued by the CBDT when he issues directions to assessees or other persons such as Treasury officers. When a direction issued by an officer under the Act is called in question in a writ petition, however, this Court has to ascertain, not only whether the authority concerned acted contrary to the instructions of the Board, but also whether the instructions of the Board are in conformity with the law laid down by the Supreme Court. The latter exercise would have to be undertaken to ensure that, while issuing directions to the officer concerned, to act in accordance with the instructions of the Board, this Court does not inadvertently direct him to act contrary to the provisions of the statute. To that effect is the caveat that was issued by a Constitutional Bench of the Supreme Court in

Commissioner of Central Excise, Bolpur v. Ratan Melting & Wire Industries - [(2008) 13 SCC 1]

where it was observed as follows;

"5. Learned counsel for the Union of India submitted that the law declared by this Court is supreme law of the land under Article 141 of the Constitution of India. The circulars cannot be given primacy over the decisions.

6. Learned counsel for the assessee on the other hand submitted that once the circular has been issued it is binding on the Revenue Authorities and even if it runs counter to the decision of this Court, the Revenue Authorities cannot say that they are not bound by it. The circulars issued by the Board are not binding on the assessee but are binding on the Revenue Authorities. It was submitted that once the Board issues a circular, the Revenue Authorities cannot take advantage of a decision of the Supreme Court. The consequences of issuing a circular are that the authorities cannot act contrary to the circular. Once the circular is brought to the notice of the Court, the challenge by the Revenue should be turned out and the Revenue cannot lodge an appeal taking the ground which is contrary to the circular.

7. Circulars and instructions issued by the Board are no doubt binding in law on the authorities under the respective statutes, but when the Supreme Court or the High Court declares the law on the question arising for consideration, it would not be appropriate for the court to direct that the circular should be given effect to and not the view expressed in a decision of this Court or the High Court. So far as the clarifications/circulars issued by the Central Government and of the State Government are concerned they represent merely their understanding of the statutory provisions. They are not binding upon the court. It is for the court to declare what the particular provision of statute says and it is not for the executive. Looked at from another angle, a circular which is contrary to the statutory provisions has really no existence in law."