(2015) 392 KLW 727

IN THE HIGH COURT OF KERALA AT ERNAKULAM

PRESENT: THE HONOURABLE MR.JUSTICE P.R.RAMACHANDRA MENON

SATURDAY, THE 20TH DAY OF DECEMBER 2014/29TH AGRAHAYANA, 1936

W.P.(C) Nos.1516, 1686, 8323, 9464, 9519, 9532, 10111, 10141, 10179, 11064, 11065, 11074, 11289, 12113, 12116, 12362, 12609, 12852, 13395, 15255, 15289, 15337, 15445, 15790, 15921, 17723, 17724, 18009, 18022, 18998, 18999, 19000, 19636 & 20548 of 2014

PETITIONER(S)

REENA GEORGE

BY ADVS.SRI.M.V.THAMBAN SRI.R.REJI SMT.THARA THAMBAN SRI.B.BIPIN

RESPONDENT(S)

1. STATE OF KERALA, REPRESENTED BY ITS PRINCIPAL SECRETARY TO THE GOVERNMENT, MOTOR VEHICLE DEPARTMENT, GOVERNMENT SECRETARIAT, THIRUVANANTHAPURAM, PIN - 695 001.

2. THE TRANSPORT COMMISSIONER, TRANS TOWERS, VAZHUTHACAUD, THIRUVANANTHAPURAM, PIN - 695 001.

3. THE REGIONAL TRANSPORT OFFICER, KOTTARAKKARA, KOLLAM DISTRICT, PIN - 691 506.

4. THE JOINT REGIONAL TRANSPORT OFFICER, SUB REGIONAL TRANSPORT OFFICE, KOTTARAKKARA, KOLLAM DISTRICT, PIN - 691 506.

BY SPECIAL GOVERNMENT PLEADER DR.SEBASTIAN CHAMPAPPILLY

JUDGMENT

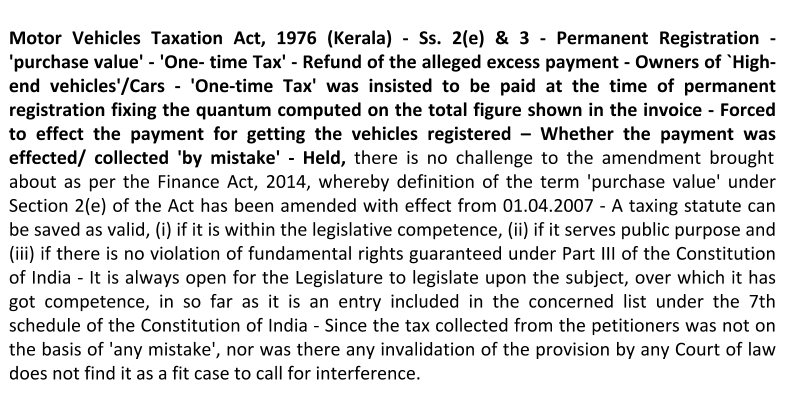

Whether the petitioners herein, who satisfied the 'One- time Tax' under the

Kerala Motor Vehicles Taxation Act

(hereinafter referred to as `the Act') at the prescribed rate, on the purchase value computed as inclusive of the VAT element as well, as part of it, are entitled to have refund of the alleged excess payment, in view of the law declared by the Division Bench of this Court as per the decision reported in 2013 (3) KLT 945 (Fathima Shirin V. Joint Regional Transport Officer), holding that the term 'purchase value' defined under Section 2(e) of the Act means only the invoice price of the vehicle, which does not include Value Added Tax paid or payable; is the question to be considered by this Court.

2. In fact, such a question was mooted earlier, by some other similarly situated persons and as per judgment dated 29.10.2014 in WP(C) No.27641 and 27676 of 2014, this Court held that the said petitioners did not have any such grievance at the time of registration of the concerned vehicles, who satisfied the tax under the Act on the entire purchase value (inclusive of the VAT element) and as such, the petitioners were not entitled to raise a stale claim. Accordingly, interference was declined and both the writ petitions were dismissed.

3. The learned counsel appearing for the petitioners in all these cases vehemently contend that, even if tax was paid voluntarily, to effect registration, in view of the law declared by the Division Bench of this Court, there was no authority for the respondents to have collected tax on the purchase value reckoning the element of VAT and as such, any tax collected without authority of law is violative of Article 265 of the Constitution of India. Such remittance has necessarily to be refunded in view of the law laid down by a Constitution Bench of the Apex Court as per the decision reported in

AIR 1959 SC 135 (The Sales Tax Officer, Banaras and others V. Kanhaiya Lal Makund Lal Saraf).

The said submission necessitates reconsideration of the entire issue and all the petitioners were heard elaborately on various aspects, including the questions of fact as well as the questions of law.

4. Petitioners herein are the owners of `High-end vehicles'/Cars, purchased by them on different dates during the years 2012,2013,2014 (as the case may be). Their common grievance is that, 'One-time Tax' was insisted to be paid at the time of permanent registration in terms of Section 3 of the Act, fixing the quantum computed on the total figure shown in the invoice, also reckoning the component of Value Added Tax. It is the case of all the petitioners that, they were forced to effect the payment as above, for getting the vehicles registered. In some cases, registration was effected even after rendering the judgment by the Division Bench of this Court in 2013 (3) KLT 945 (cited supra), declaring the law. Anyhow, since the law stands declared, there was no authority for the respondents to have collected tax to the said extent and as such, the excess is claimed to be refunded. In some cases, the petitioners have filed a petition claiming refund, which have not been acted upon favourably and hence the writ petitions. In other cases, referring to the law laid down by the Division Bench, the concerned petitioners have directly approached this Court, claiming refund.

5. For convenience of reference, factual particulars to the limited extent as necessary, are extracted below, in a tabulated form:

Sl. No. Type of vehicle with Registration No. Date of invoice Date of registration 1. 1516/2014 24.09.2013 22.10.2013 2. 1686/2014 Toyota Innova Car KL-24-H-50 14.09.2013 21.10.2013 3. 8323/2014 'Polar White' Mercedes Benz ML250CDI KL-11-AU-5 04.02.2014 4. 9464/2014 Audi A6 Car KL-31-F-999 25.04.2013 03.05.2013 5. 9519/2014 Toyota Fortuner-FX Car KL-31-F-777 11.09.2013 19.09.2013 6. 9532/2014 Mercedes Benz E220CDI Elegance Car KL-31-E-7 22.08.2012 04.09.2012 7. 10111/2014 Audi Q3 LMV-Motor Car KL-07-BY-7950 30.09.2013 15.10.2013 8. 10141/2014 Audi Q5 Car KL-33-E-5999 11.07.2013 22.07.2013 9. 10179/2014 Toyota Fortuner Motor Car 19.12.2013 10. 11064/2014 BMW 118d Hatch LMV Motor Car KL-07-BY-7775 27.09.2013 28.10.2013 11. 11065/2014 Range Rover Evoque SD 4 KL-07-BU-777 29.02.2012 02.04.2012 12. 11074/2014 BMW MINI SV 32 LMV Motor Car KL-07-BZ-7775 16.01.2014 22.02.2014 13. 11289/2014 Volvo S60 D4 SUMMUM LMV-Motor Car KL-01-BP-4000 13.02.2014 03.03.2014 14. 12113/2014 Toyota Innova Car KL-31-G-222 06/12/13 24.12.2013 15. 12116/2014 Toyota Fortuner KL-31-F-9 26.02.2013 04.03.2013 16. 12362/2014 LMV Motor Car KL-08-BC-7077 20.03.2014 27.03.2014 17. 12609/2014 Chevrolet Sail Car KL-29-G-9475 16.01.2014 14.02.2014 18. 12852/2014 Toyota ETIOS KL-29-G-7168 16.11.2013 12.12.2013 19. 13395/2014 Mercedes Benz LMV KL-08-BC-8585 21.03.2014 31.03.2014 20. 15255/2014 Audi A4 KL-01-BJ-2500 29.11.2012 06.12.2012 21. 15289/2014 Mercedes Benz KL-01-BN-3000 12/11/13 29.11.2013 22. 15337/2014 Audi A4 KL-22-E-999 11/03/13 25.03.2013 23. 15445/2014 Mercedes Benz LMV Motor Car KL-26-E-5566 22.02.2014 21.03.2014 24. 15790/2014 Mercedes Benz LMV Motor Car KL-43-F-6008 15.03.2014 31.03.2014 25. 15921/2014 Mercedes Benz LMV Motor Car KL-07-CA-156 29.03.2014 31.03.2014 26. 17723/2014 Audi Q3 LMV- Motor Car KL-07-BY-555 28.06.2013 15.07.2013 27. 17724/2014 Mercedes Benz LMV Motor Car KL-07-BX-4343 21.03.2013 29.04.2013 28. 18009/2014 Neo Elantra KL-26-E-900 14.09.2013 30.09.2013 29. 18022/2014 Mitsubishi Pajero Sport KL-29-G-2211 04/07/13 16.07.2013 30. 18998/2014 BMW Car KL-09-AG-222 31.08.2013 07.10.2013 31. 18999/2014 Mercedes Benz Car KL-07-BW-7118 16.02.2013 16.02.2013 32. 19000/2014 BMW Car KL-07-BW-9068 19.02.2013 14.03.2013 33. 19636/2014 Toyota Fortuner KL-18-M-369 06/09/13 19.11.2013 34. 20548/2014 BMW KM42 LMV Motor Car KL-07-BS-4006 01/09/11 24.09.2011

6. A Counter Affidavit has been filed in the lead case W.P. (C) No.1516/2014, which is stated as being adopted in all other cases. There is no dispute from either side, as to the factual position and the point to be considered is more with regard to the question of law. The gist of the contention raised from the part of the respondents is that, the term `sale price'/ `purchase value' constitutes different components and tax is liable to be paid under two different statutes, at two distinct points of transactions. The taxable event with reference to Kerala Value Added Tax is at the time of sale or purchase, which is added to the unit price of the vehicle. Thereafter, when the vehicle is taken up for registration before the authorities of the Motor Vehicles Department, tax under the Kerala Motor Vehicles Taxation Act is to be paid at the prescribed rate, as on the date of permanent registration, reckoning the purchase value, which had to be spent by the petitioners/purchasers who own the vehicle. In other words, the taxable event under the Kerala Motor Vehicles Taxation Act occurs at the time of 'permanent registration', by which time, the value came to be added on, which alone can be reckoned for the purpose of taxation under the said Act. It is also pointed out that, the Division Bench, as per the decision in 2013 (3) KLT 945 (cited supra), only interpreted the provision, particularly the definition of the term `purchase value' as given under Section 2(e) of the Act and held that, it will not include the VAT component, Customs duty or such other elements. This necessitated a clarification, which was brought about by amending the definition of the term `purchase value', as per Section 7(1)(e) of the Finance Act, 2014, retrospectively with effect from 01.04.2007 (i.e., when the provision was introduced for the first time, stipulating payment of 'One-time Tax'). This being the position, the claim of the petitioners for refund is stated as thoroughly wrong and misconceived and not liable to be entertained.

7. Mr. R. Reji, the learned counsel led the arguments on behalf of the concerned petitioners, supported by the learned lawyers appearing for the petitioners in other cases. The learned counsel pointed out that, the verdict passed by the Division Bench of this Court as per 2013 (3) KLT 945 (cited supra) is a 'declarative judgment' and that the benefit is liable to be extended to all concerned. It is also pointed out that, a Review petition filed against the said judgment came to be dismissed, holding that 'there was no error apparent on the face of the records'. SLP preferred before the Apex Court at the instance of the State/Department also came to be dismissed. It is contended that, if any money is paid by mistake by one party to the other, there is an obligation to repay, by virtue of the terms of Section 72 of the Indian Contract Act, which principle was accepted, adopted and applied by the Apex Court with regard to the field of taxation as well, as evident from the decision was rendered by a Constitution Bench of the Apex Court in AIR 1959 SC 135 (cited supra), holding that the excess amount collected by the State was liable to be refunded. It is also pointed out that, merely for the reason that the amount so collected by the State had already been utilised for other purposes, cannot be a ground for not effecting the refund. Reliance was placed more on the observations made by the Apex Court in paragraphs 26 and 32 of the said verdict. It is also contended that, the attempt of the State is virtually to nullify the judgment passed by the Division Bench in 2013 (3) KLT 945 (cited supra) and as such, it cannot bar the way of the petitioners in any manner.

8. Dr. Sebastian Champappilly, the learned Special Government Pleader (Taxes), appearing for the State/ Department, points out that the amendment brought about to the term 'purchase value' under Section 2(e) of the Act as per the Finance Act 2014 is only 'clarificatory in nature', as nothing new was introduced. It is stated that, right from the beginning, ever since the introduction of the concept of 'One time Tax' with effect from 01.04.2007, tax was being computed and collected based on the total amount spent by the party to purchase the vehicle, which included the manufacturer's cost, Excise duty, Dealer's profit/freight, VAT element/Customs duty and such other components. Scope of the provision was intended by the Legislature to the said extent, which was being understood and applied by all concerned, including Dealers, Customers and Departmental/authorities. As such, collection of tax by the Department and payment by the petitioners was 'never by a mistake' at any point of time, but on the correct understanding of the law. However, in view of the interpretation given by the Division Bench of this Court in 2013 (3) KLT 945 (cited supra), the position required to be clarified further, which accordingly was done by the Legislature, as per the Finance Act, 2014, amending the term 'purchase value' under Section 2(e) of the Act, as per Section 7(e) of the said Finance Act. Reliance is sought to be placed on the decision rendered by the Apex Court in

Bhuvaneshwar Singh and another Vs. Union of India and others [1994 (6) SCC 77]

to the effect that, there is no attempt to nullify the judgment, but for clarifying the position, as it was originally intended by the Legislature and that the amendment, even otherwise, is virtually a 'Validating Act', giving retrospective effect from 01.04.2007. The clarification provided is not with reference to the judgment, but with reference to the intent of legislation, which was brought into force from 01.04.2007, which is never to override any judgment. It is also pointed out, placing reliance on the verdict passed by the Apex Court in

Mafatlal Industries Ltd. etc. Vs. Union of India etc. [(1997) 5 SCC 736

(paragraph 108)], that, merely because of somebody else had approached the Court and won the case, the strangers, who were watching the show, standing elsewhere, are not supposed to have the benefit of refund. It is also pointed out, placing reliance on the decision in Mafatlal's case (cited supra), that the State can take a plea that the money collected had already been spent for various other purposes and hence not liable to be returned. The said contention is opposed by the learned counsel for the petitioners, stating that such a question was considered by the Constitution Bench of the Apex Court in AIR 1959 SC 135 (cited supra) and it was repelled.

9. For understanding the scope of legal position, it is necessary to have a look at definition of the term 'purchase value' under Section 2(e) of the Act, as it existed before (at the time of passing judgment by the Division Bench in 2013 (3) KLT 945 (cited supra) and the position, as it now exists (with retrospective effect from 01.04.2007) by virtue of the amendment brought about as per the Finance Act, 2014.

10. Section 2(e) (prior to amendment) reads as follows:

"(e) "purchase value" means the value of the vehicle as shown in the original purchase invoice:

Provided that where the purchase value of any vehicle including a vehicle imported from other countries or a vehicle acquired or obtained otherwise than by way of purchase, is not ascertainable on account of non-availability of the invoice, then the purchase value shall be the value or price at which the vehicles of like kind or of same specifications is already registered or available with the manufacturer or as fixed by the Customs and Central Excise Department for the purpose of levying customs duty, as the case may be."

Section 2(e) (after amendment) reads as follows:

"(e) "purchase value" means the value of the vehicle as shown in the purchase invoice and includes value added tax, cess and customs/excise duty chargeable on vehicles:

provided that the discount or rebate given by the dealer to the registered owner shall not be deducted from the bill amount for computing the purchase value; provided further that where the purchase value of any vehicle including a vehicle imported from other countries or a vehicle acquired or obtained otherwise than by way of purchase is not ascertainable on account of non availability of invoice, the purchase value shall be the value of price of the vehicles of the same specifications which are already registered or available with the manufacturer or as fixed by the Customs and Central Excise Department for the purpose of levying customs duty and includes excise or customs duty levied on the purchase of motor vehicle, as the case may be.

11. It is relevant to note that, none of the provisions under the Act was declared as ultra vires or set aside by the Division Bench as per the verdict in 2013 (3) KLT 945 (cited supra). What has been done is that, a proper interpretation was given to the term 'purchase value' under Section 2(e) of the Act (pre-amended). The learned Judges observed that, the term 'purchase value' under Section 2(e) of the Act 'means' the value of the vehicle as shown in the original purchase invoice and since the Legislature uses the tool 'means', it means what is said and nothing beyond. It was accordingly held that, the definition was a 'hard and fast one' and no other meaning could be assigned to the term 'so defined'.

12. According to the law-makers, what was intended under the statute while defining the term 'purchase value' under Section 2(e) and other relevant provisions, particularly the charging provision under Section 3, was to realise tax at the prescribed rate on the total purchase price, which included various components such as Excise duty, Customs duty (as the case may be), Value Added Tax etc. Right from the beginning, ever since the introduction of 'One time Tax' with effect from 01.04.2007, it was being computed and collected accordingly and this paved way for amendment of the provision as per the Finance Act, 2014, clarifying the position as originally intended; thus giving effect to the amended provision retrospectively from 01.04.2007 onwards. The point to be considered is whether the amendment is to defeat the judgment or it amounts to a validating event, removing the substratum of the judgment, if it were defective.

13. The scope of a 'Validating Act' providing for retrospective operation, removing the defect in or change the basis of the principal Act, which was the cause of the invalidated Act or part thereof by the Court, had come up for consideration before the Apex Court in (1994) 6 SCC 77 (cited supra). The Apex Court observed that the Parliament and State Legislature had plenary powers of legislation on the subject within their field and they can legislate on the said subject prospectively as well as retrospectively. It was held that, if the intention of the legislature is clearly expressed that, it purports to introduce the legislation or to amend an existing legislation retrospectively, then, subject to the legislative competence and exercise being not in violation of any of the provisions of the Constitution, such powers cannot be questioned. After meticulous analysis, the Apex Court further observed that, 'Validating Acts' are enacted to validate the action taken under the relevant enactments, by rectifying the defect in the statute retrospectively, because of which the statute or part of it had been 'declared ultra vires' and that, such exercise rendering the judgments/orders ineffective while changing the very basis/substratum, by way of legislation, is a well-known device of validating legislation, which only removes the cause of invalidity and the same cannot be considered to be an encroachment on judicial power. The legislation cannot nullify the judgment itself, but its base, by removing the defect, which led to the judgment.

13. The factual position involved in the said case was with reference to the management of the petitioners' Coking Coal Mine taken over by the Central Government under Section 3 of the Coking Coal Mines (Emergency Provisions) Ordinance, 1971 from 07.10.1971 to 30.04.1972, followed by the relevant Act, absolutely vesting the title and interest of the owner in the Mine, with the Central Government, with effect from 01.05.1972. During the aforesaid period, the Mine was in the custody of the custodian appointed by the Central Government. The claim put forth was with reference to the sale price of coal extracted and 'lying in stock', at the commencement of the appointed date, which was to be taken into account, for determining the profit and loss during the period of management of the Mine by the Central Government. By virtue of the Coal Mine Nationalisation Laws (Amendment Ordinance), 1986 replaced by the subsequent Amendment Act, provisions were incorporated to the effect that the price paid to the owners would include the 'cost of the coal in stock' as well (Section 10(2) introduced with retrospective effect from 01.05.1972, and the validating provision of Section 19 of the said Act). It was contended that, the said amendment was to nullify the judgment rendered by the Apex Court earlier in

Central Coal Fields Limited Vs. Bhuvaneswar Singh [(1984) 4 SCC 429]

Referring to the relevant provisions of the amended Act, the Court observed that the question was, whether by introduction of Section 10(2) with retrospective effect from 01.05.1972, the respondents were absolved of their liability and were exonerated from the responsibility to comply with the directions given by the High Court and the Apex Court in the earlier round of litigation and whether it was an attempt to defeat or nullify the judgment.

14. The observations made by the Apex Court in 'paragraph 11' are very relevant, which is extracted below:

"11. Admittedly, the amount claimed from the owner represents the cost of extraction of the coal from the mine. The appellants had conceded before the High Court and Mr. Sinha appearing for them before us accepted the position that if the extracted coal had been sold before the appointed day, the owner would have been entitled to the price. The mere fact that the extracted coal remained in stock at the commencement of the appointed date can make no difference to the position. The expenses were to be set off against the sale price of the stock to be received at the time of disposal. Therefore, the stock of coal had to be taken into account for balancing the position. Reliance on the definition of 'mine' and Section 10 of the Nationalisation Act to counteract this conclusion cannot avail the appellants. Indeed, the submission advanced on behalf of the appellants is so much opposed to common sense logic of the matter that in the absence of a legislative mandate we have no hesitation in rejecting it."

After considering the relevant provisions, the Court observed that, if the provision, as introduced by the amended Act had existed from the very inception, there would have been no occasion for the High Court or Supreme Court to issue any direction for taking into account the price, which was payable for the 'stock of Coke' lying on the date before the appointed day, simultaneously observing that, the authority to introduce the provision with retrospective effect cannot be questioned. Once the amendment has been introduced retrospectively, the Bench observed, the Court has to act on the basis of such provision as if it was there, since the beginning. It was accordingly, that interference was declined and the case was dismissed. The above verdict was passed also placing reliance on the observations made by a Constitution Bench of the Apex Court in

Sri. Prithvi Cotton Mills Ltd. etc. Vs. Broach Borough Municipality and others ([1969] 2 SCC 283-AIR 1970 SC 192)

Paragraph 4 of the said decision is very relevant and hence reproduced herein below:

"4. Before we examine Section 3 to find out whether it is effective in its purpose or not we may say a few words about validating statutes in general. When a Legislature sets out to validate a tax declared by a court to be illegally collected under an ineffective or an invalid law, the cause for ineffectiveness or invalidity must be removed before validation can be said to take place effectively. The most important condition, of course, is that the Legislature must possess the power to impose the tax, for, if it does not, the action must ever remain ineffective and illegal. Granted legislative competence, it is not sufficient to declare merely that the decision of the Court shall not bind for that is tantamount to reversing the decision in exercise of judicial power which the Legislature does not possess or exercise. A court's decision must always bind unless the conditions on which it is based are so fundamentally altered that the decision could not have been given in the altered circumstances. Ordinarily, a court holds a tax to be invalidly imposed because the power to tax is wanting or the statute or the rules or both are invalid or do not sufficiently create the jurisdiction. Validation of a tax so declared illegal may be done only if the grounds of illegality or invalidity are capable of being removed and are in fact removed and the tax thus made legal. Sometimes this is done by providing for jurisdiction where jurisdiction had not been properly invested before. Sometimes this is done by re-enacting retrospectively a valid and legal taxing provision and then by fiction making the tax already collected to stand under the re-enacted law. Sometimes the Legislature gives its own meaning and interpretation of the law under which tax was collected and by legislative fiat makes the new meaning binding upon courts. The Legislature may follow any one method or all of them and while it does so it may neutralise the effect of the earlier decision of the court which becomes ineffective after the change of the law. Whichever method is adopted it must be within the competence of the legislature and legal and adequate to attain the object of validation. If the Legislature has the power over the subject-matter and competence to make a valid law, it can at any time make such a valid law and make it retrospectively so as to bind even past transactions. The validity of a Validating Law, therefore, depends upon whether the Legislature possesses the competence which it claims over the subject-matter and whether in making the validation it removes the defect which the courts had found in the existing law and makes adequate provisions in the Validating Law for a valid imposition of the tax."

15. The Bench observed that, the attempt to validate the tax collection under a defective/invalid law, could be rectified by way of different methods as mentioned therein, holding that sometimes it is done by providing jurisdiction, where jurisdiction had not been properly invested before; sometimes by way of retrospective enactment and then by fiction making the tax already collected to stand and sometimes by giving its own meaning and interpretation to the term/law by the legislature, under which tax was collected. It has been held that, the legislature may follow any one method or all of them and once it is done, it may neutralise the effect of the earlier decision of the Court, which becomes ineffective after the change in law. This alone has taken place in the instant case as well. As mentioned already, the Division Bench of this Court, as per the judgment in 2013 (3) KLT 945 (cited supra), has not declared any provision of the Act as ultra vires or invalid or set aside the same, but for giving a restrictive meaning to the term 'purchase value' defined under Section 2 (e) of the Act. The legislature has given the actual and intended meaning to the said term, by virtue of the amendment, as per the Finance Act, 2014, giving retrospective effect to the provision, as it was intended to mean with effect from 01.04.2007. This of course is a situation envisaged, recognised and certified to be valid, by the Constitution Bench of the Apex Court in AIR 1970 SC 192 and as such, the contention of the petitioners that the amendment is to defeat the judgment passed by the Division Bench, is not liable to be sustained and hence rejected accordingly.

16. The next question to be considered is with regard to the scope and applicability of the ruling rendered by the Constitution Bench of the Apex Court in AIR 1959 SC 135 (cited supra), to enable the petitioners to have refund. The factual position involved in the said case was that, the assessee firm, who was dealing in bullion gold and silver ornaments and forward contracts in the State of U.P., was assessed under the U.P. Sales Tax Act on its forward transactions in silver bullion, which was accordingly satisfied. Subsequently, the levy of sale tax of forward transactions was held to be ultra vires by the High Court of Allahabad, as per judgment dated 27.02.1952 in

Budhaprakash Jayaprakash Vs. STO Kanpur (AIR 1952 All 764)

The assessee sought for refund in the said circumstances, which was refused by the Department. The assessment was sought to be quashed, simultaneously seeking for refund, by filing writ petition before the Allahabad High Court, also pointing out that the declaration of law by the Allahabad High Court as to the ultra vires nature of the statutory provision, was confirmed by the Apex Court as per judgment dated 03.05.1954 in

STO Vs. Budhaprakash Jayaprakash (AIR 1954 SC 459)

The learned Single Judge of the Allahabad High Court allowed the writ petition, which was affirmed by the Division Bench, dismissing the appeal preferred by the State/Department, leading to the case filed before the Apex Court. After considering the facts and figures and the relevant provisions of law, the Bench observed that the principle behind Section 72 of the Indian Contract Act could very much be pressed into service and that the payment made under 'mistake of law', is repayable.

17. Coming to the case in hand, as mentioned herein before, there is no change in the legal position, especially by virtue of the amendment brought about as per the Finance Act, 2014, giving the actual meaning of the term 'purchase value' defined under Section 2(e), as it was originally intended by the Legislature. As pointed out from the part of the respondents, the term 'purchase value' under Section 2(e) was intended, understood, accepted and being applied by all concerned, quantifying the tax and collecting the same also reckoning the VAT component/Customs duty/Excise duty as part of the 'purchase value', for fixing the tax liability under the Act. There is no case for the petitioners that, any deviation was made by the respondents/Department at any point of time, to have had a different course and no such instance is pointed out anywhere in these writ petitions. The petitioners admittedly satisfied the tax at the time of registration of the vehicle at the specified rate, also reckoning the element of Value Added Tax and there was no grievance for them at any point of time earlier. The heartburn started only on the successful outcome of the challenge raised by some owners of the vehicles, leading to the judgment rendered by the Division Bench in 2013 (3) KLT 945 (cited supra), giving a restrictive meaning to the term 'purchase value' as defined under Section 2(e) of the Act. By virtue of the amendment of the provision as per the Finance Act, 2014, the substratum of the judgment rendered by the Division Bench has been taken away or stands rectified, curing the defect/obscurity, if any, giving the actual meaning as it was originally intended by the Legislature, when the charging provision was introduced with effect from 01.04.2007. This of course is an exercise done by the Legislature, by pursuing appropriate course certified to be valid by the Constitution Bench of the Apex Court as per the decision in AIR 1970 SC 192 (paragraph 4-extracted herein before). In other words, the payment effected by the petitioners was never under any mistake in law and the mistake if at all any or the ambiguity is no more in existence, in view of the amendment of the term 'purchase value' brought about with retrospective effect from 01.04.2007. As it stands so, the case of the petitioners stands entirely on a different footing, than the position considered by the Apex Court in the decision reported in AIR 1959 SC 135 (cited supra).

18. The crux of the other contentions raised by the respondents is to the effect that, payment of tax effected by the petitioners at the time of registration was without registering any protest and it was obviously due to the fact that they had also understood the legal position in the correct manner, as intended by the law-makers and as conceived by the Departmental authorities. It is further stated that, the amount satisfied by the petitioners as tax has already been utilised by the Government for various purposes/ developmental measures; to meet the day-to-day needs of the Government or for the benefit of the general public and the State is not in a position to put the clock back. If at all any refund is to be effected to the petitioners, who are sporting a 'Mercedes Benz' or 'BMW' or such other vehicles, it will be at the cost of the common tax payers, including the owner of an Autorickshaw. The claim of the petitioners under such circumstances, who were sleeping over arm chair, is not liable to be entertained or redressed by this Court, invoking the discretionary jurisdiction under Article 226 of the Constitution of India, more so in the light of the law declared by the Apex Court itself in

Rabindra Nath Bose and others V. Union of India and others (AIR 1970 SC 470)

19. It is true that, in some cases like WP(C) No.13395 of 2014, the petitioners have filed application (Ext.P5) before the concerned RTO under

Rule 15 of the Kerala Motor Vehicles Taxation Rules.

The said Rule enables the RTO to sanction, on application, refund of any tax paid or collected by mistake or in excess or remitted under a wrong head of account, provided such application in writing is preferred with evidence of payment within one year from the date of payment. But, the question here again is, whether the payment was effected/ collected 'by mistake'. Since the payment was effected, admittedly without any protest and since it was collected as the provision was understood in the manner, reckoning the element of VAT component as well, as part of the 'purchase value' defined under Section 2(e). (till it was declared otherwise by the Division Bench of this Court in 2013 (3) KLT 945) (cited supra) and further since the defect/obscurity in the statute stands removed as per the amendment (by way of Finance Act, 2014) brought into effect from 01.04.2007, the payment can be never regarded as made/collected under mistake. That apart, the validity of the amendment as per the Finance Act, 2014, giving retrospective effect from 01.04.2007, is not under challenge in any of these writ petitions. This being the position, this Court does not find any basis for the claim. That apart, if the claim of the petitioners is to be entertained, it is possible for anybody who has satisfied the tax without any protest and without any mistake right from 01.04.2007, to approach the Department or this Court for similar relief. It will lead to massive erosion of the economic base of the State. In so far as the tax was paid and collected on the basis of the actual understanding of the legal provision as on that date, till the contrary position was explained by the Division Bench of this Court as per the decision cited supra, there cannot be any interference in these writ petitions.

20. Scope of the decision rendered by '5 Member Bench' of the Apex Court in AIR 1959 SC 135 (cited supra) came to considered and explained by a larger Bench (consisting of '9' Judges) in

Mafatlal Industries Ltd. Vs. Union of India and others reported in (1997) 5 SCC 536

The Bench observed that, declaration of unconstitutionality however obtained by another person, on another ground, cannot be availed of by such person to reopen the decision in the said case. In the instant cases, the petitioners had not moved any forum or this Court, challenging the course of action sought to be pursued by the respondents and the tax was satisfied without demur at the time of registration of the vehicle.