(2015) 392 KLW 187

IN THE HIGH COURT OF KERALA AT ERNAKULAM

PRESENT: THE HONOURABLE THE AG.CHIEF JUSTICE MR.ASHOK BHUSHAN THE HONOURABLE MR.JUSTICE A.M.SHAFFIQUE THE HONOURABLE MR. JUSTICE A.V.RAMAKRISHNA PILLAI THE HONOURABLE MR. JUSTICE A.HARIPRASAD & THE HONOURABLE MR. JUSTICE A.K.JAYASANKARAN NAMBIAR

WEDNESDAY, THE 21ST DAY OF JANUARY 2015/1ST MAGHA, 1936

MACA. No.585 of 2003

AGAINST THE AWARD IN OP(MV) NO. 924/1996 ON THE FILES OF THE MOTOR ACCIDENTS CLAIMS TRIBUNAL, IRINJALAKUDA DATED 23-09-2002.

APPELLANT(S)/2ND RESPONDENT

THE ORIENTAL INSURANCE COMPANY LIMITED, CHALAKKUDY, NOW REPRESENTED BY ITS ASSISTANT MANAGER, REGIONAL OFFICE, METRO PALACE, KOCHI-18. BY ADV. SRI.MATHEWS JACOB (SR.)

RESPONDENT(S)

1. POULOSE, S/O. OUSEPH, GOPURAM HOUSE, RESIDING AT NALUKETTU DESOM, KORATTY,KIZHAKKUMMURI, NALUKETTU P.O.

2. M.O. KOCHAGUSTHY,S/O. OUSEPH, MALIEKKA HOUSE, CHERUVALOOR P.O., (VIA) KORATTY.

R1 BY ADVS. SRI.P.V.BABY SRI.A.N.SANTHOSH R2 BY ADVS. SRI.K.I.ABDUL RASHEED SRI.K.A.SHAMSUDEEN SRI.K.J.MOHAMMED ANZAR SMT.BHAMA G. NAIR

JUDGMENT

Ramakrishna Pillai, J

"Whether a driving licence which stood expired on the date of the road traffic accident and was not renewed within the statutory period would fulfill the requirement of 'duly licenced' under Section 149(2)(a)(ii) of the Motor Vehicles Act, 1988 (for short, the Act)" ?

This is the primary question we are called up on to answer in this reference made by the Full Bench. Incidentally, we have to consider

whether, the insurer could be exonerated from the liability of compensating the claimant or whether the insurer be directed to satisfy the award and to recover the award amount so paid, from the insured.

2. When this appeal, filed by the insurer who was directed by the claims Tribunal to satisfy the award, came up for consideration of the Division Bench, the Division Bench noticed an apparent conflict between the decision of the Full Bench of this Court in

Oriental Insurance Company v. Paulose [2004 (1) KLT 8 (F.B)]

and the decisions of the Apex Court in

Malla Prakasarao v. Malla Janaki and others [(2004) 3 Supreme Court Cases 343]

as well as

National Insurance Co. Ltd. v. Kusum Rai [2006 ACJ 1336 (SC)]

Therefore, the Division Bench referred the matter to a Full Bench. The Full Bench, however, was of the opinion that the matter requires reconsideration by a Larger Bench in view of the decision of the Apex Court in

Ram Babu Tiwari v. United India Insurance Co. Ltd. and others (2008 ACJ 2654)

and other cases. Thus, the matter has come up before us.

3. The relevant facts of the case may be briefly stated: The claim petition under Section 166 of the Act was filed by the first respondent herein for compensation to the tune of 3 lakhs for the injuries sustained by him in a road traffic accident occurred on 7.3.1996. His case was that while he was standing on the side of a road, a goods vehicle owned and driven by the second respondent knocked him down causing serious injuries to him. The second respondent against whom negligence was alleged, remained ex parte. The appellant/insurer while admitting the policy of the offending vehicle contended that the second respondent was not 'duly licenced' at the time of accident, i.e., on 7.3.1996, for the reason that the driving licence of the second respondent expired on 24.6.1995. The Tribunal after considering the evidence found that the second respondent was rash and negligent and passed an award for 1,36,900/- with interest which was directed to be paid by the appellant.

4. This appeal has been filed aggrieved by the said award. In the appeal, the appellant would contend that the Tribunal ought to have accepted the contention of the appellant that it is not liable to compensate the first respondent as the second respondent was not duly licensed at the time of accident.

5. We have heard Mr. Mathews Jacob, the learned Senior Counsel appearing for the appellant and Mr. P. V.Baby, the learned counsel for the first respondent/claimant.

6. Mr. Mathews Jacob argued that going by Section 3 of the Act, in order to clothe the insurer with the liability of compensating the claimant, the driver of the offending vehicle should have an effective driving licence at the time of the accident. Inviting our attention to Section 2(10) of the Act which defines driving licence and Section 3 of the Act which mandates the necessity of a driving licence, Mr. Mathews Jacob argued that in the light of Section 3 of the Act any person driving the vehicle should have an "effective valid driving licence" on the date of accident and the absence of an effective driving licence in this case has resulted in violation of the conditions of the policy under Section 149(2)(a)(ii) of the Act.

7. The learned counsel for the first respondent, per contra, would submit that the contention of the insurance company that breach of policy is automatic in such a situation cannot be accepted, and going by the facts of the present case, the claimant is a third party and the appellant has no case that absence of driving licence of the second respondent is the root cause of the accident. Therefore, the insurance company has the liability to compensate the claimant; so submitted the learned counsel for the first respondent.

8. In this case, it is an admitted fact that the accident was on 7.3.1996 and driving licence of the first respondent who was the owner-cum-driver of the offending vehicle expired on 24.6.1995.

9. The Full Bench in Oriental Insurance Company v. Paulose (cited supra) had considered the question whether the insurer would be absolved of the liability to indemnify the insured merely because the driver's licence had not been renewed on the date of the accident. In that case the accident occurred on 23.5.1997 and the insurance policy was subsisting as on that date. The period of validity of the driving licence of the third respondent who was the driver of the vehicle expired on 30.11.1996. However, he renewed it later on 18.6.1997. The Full Bench observed that even if the licence had expired on the date of the accident, its subsequent renewal would fulfill the mandate of the statute. According to the Full Bench, the definition of licence in the Act does not stipulate any period of validity and once the licence is issued to a driver, it should be regarded that it has been duly issued. It was held that as the period of effectiveness of a licence could be renewed at its expiry, in spite of expiry of its validity period, the licence continued to exist unless it was shown that the licensee had been disqualified to hold the same.

10. One of the conflicting decisions noticed by the Division Bench which considered this appeal for the first time was the decision of the Apex Court in

Malla Prakasarao v. Malla Janaki and others [(2004) 3 Supreme Court Cases 343]

The Apex Court while disposing of certain civil appeals arising out of motor accidents claims considered the meaning of the words "duly licensed" occurring in Section149 (2)(a)(ii) of the Act. The finding of the courts below in one of the cases was that the insurance company had no liability to pay compensation as the accident was caused by a vehicle driven by a driver without a driving licence. This was in challenge before the Apex Court. There, it was not disputed that the driving licence of the driver of the vehicle had expired on 20.11.1982 and the driver did not apply for renewal within thirty days of expiry of the said licence as required under Section 11 of the the Motor Vehicles Act, 1939 (unamended Act). It was also not disputed that the driver did not have a driving licence when the accident took place.

11. The Apex Court held that, according to the terms of the contract, an insurance company has no liability to pay compensation where an accident was caused by a vehicle driven by a person without a driving licence and in that view of the matter, the said appeal was dismissed confirming the judgment of the High Court.

12. The other conflicting decision noted by the Division Bench was

National Insurance Co. Ltd. v. Kusum Rai [2006 (2) KLT 300]

In that case, it was not in dispute that the offending vehicle was being used as a taxi i.e. as a commercial vehicle, the driver of which was required to hold an appropriate licence. There, the driver at the relevant time of the accident was the holder of a licence to drive light motor vehicle and did not possess a licence to drive a commercial vehicle. The Apex Court held that there was a breach of the condition of contract of insurance and the insurance company could raise the said defence. The principle laid down in Kusum Rai's case (supra) was re-iterated by the Apex Court in

Ishwar Chandra and others v. Oriental Insurance Co. Ltd and others (2007 ACJ 1067)

and still later, in

Ram Babu Tiwari v. United India Insurance Co. Ltd. and others (2008 ACJ 2654)

i.e., the decision noticed by the Full Bench which referred the matter for the consideration of the Larger Bench.

13. In Ishwar Chandra's case (cited supra), the Apex Court referring to sub-section (1) of Section 15 of the Act observed that from a bare perusal of the said provision, it would appear that the licence is renewed in terms of the Act and the rules framed thereunder. The proviso to Section 15(1) of the Act states in no uncertain terms that the original licence granted, despite expiry, remains valid for a period of 30 days from the date of expiry and if an application for renewal thereof is filed thereafter, the same would be renewed from the date of its renewal; so found the Apex Court. In that case, on the date of the accident, the renewal application had not been filed by the driver and, therefore, the Apex Court found that the driver did not have a valid licence when the vehicle met with the accident.

14. In Ram Babu Tiwari's case (supra), the accident took place on 27.1.1996. The Tribunal on evidence found that the driver was having valid licence only for the period from 11.2.1992 to 10.2.1993 and from 7.2.1996 to 6.2.1999. In other words, the driver did not hold any licence during the period from 11.2.1993 to 6.2.1996 which covered the date of the accident. The Tribunal refused to exonerate the insurer from the liability of paying the compensation. However, in appeal, the High Court following the decision of the Apex Court in

National Insurance Company Ltd. v. Swaran Singh [(2004) 3 SCC 297]

reversed the finding of the Tribunal and held that the amount of compensation should be paid by the appellant/insurance company and the same be recovered from the driver and the owner of the vehicle. The Apex Court considered the various decisions referred to above, including the decision in Swaran Singh's case (cited supra), and dismissed the appeal confirming the award.

15. It is useful to have a look at the relevant provisions of the Act.

16. Section 2(10) of the Act defines driving licence to mean the licence issued by a competent authority under Chapter II authorising the person specified therein to drive, otherwise than a learner, a motor vehicle or a motor vehicle of any specified class or description.

17. The necessity for a driving licence is stated in Section 3 of the Act, which reads as follows:

"No person shall drive a motor vehicle in any public place unless he holds an effective driving licence issued to him authorising him to drive the vehicle; and no person shall so drive a transport vehicle other than a motor cab or motor cycle hired for his own use or rented under any scheme made under sub-section(2) of Section 75 unless his driving licence specifically entitles him to do so. (2) The conditions subject to which sub-section (1) shall not apply to a person receiving instructions in driving a motor vehicle shall be such as may be prescribed by the Central Government."

(emphasis added)

18. Sections 14 and 15 of the Act deal with the currency of driving licences to drive motor vehicles and renewal of driving licences respectively. These sections read as under:

(1) A learner's licence issued under this Act shall, subject to the other provisions of this Act, be effective for a period of six months from the date of issue of the licence.

(2) A driving licence issued or renewed under this Act shall,-

(a) in the case of a licence to drive a transport vehicle, be effective for a period of three years:

[Provided that in the case of licence to drive a transport vehicle carrying goods of dangerous or hazardous nature be effective for a period of one year and renewal thereof shall be subject to the condition that the driver undergoes one day refresher course of the prescribed syllabus; and]

(b) in the case of any other licence,-

(i) if the person obtaining the licence, either originally or on renewal thereof, has not attained the age of fifty years on the date of issue or, as the case may be, renewal thereon,-

(A) be effective for a period of twenty years from the date of such issue or renewal; or

(B) until the date on which such person attains the age of fifty years, whichever is earlier;

[(ii) if the person referred to in sub-clause (i), has attained the age of fifty years on the date of issue or as the case may be, renewal thereof, be effective, on payment of such fee as may be prescribed, for a period of five years from the date of such issue or renewal:]

Provided that every driving licence shall, notwithstanding its expiry under this sub-section continue to be effective for a period of thirty days from such expiry.

(emphasis added)

(1) Any licensing authority may, on application made to it, renew a driving licence issued under the provisions of this Act with effect from the date of its expiry:

Provided that in any case where the application for the renewal of a licence is made more than thirty days after the date of its expiry, the driving licence shall be renewed with effect from the date of its renewal:

Provided further that where the application is for the renewal of a licence to drive a transport vehicle or where in any other case the applicant has attained the age of forty years, the same shall be accompanied by a medical certificate in the same form and in the same manner as is referred to in sub-section (3) of section 8, and the provisions of sub-section (4) of section 8 shall, so far as may be, apply in relation to every such case as they apply in relation to a learner's licence.

(2) An application for the renewal of a driving licence shall be made in such form and accompanied by such documents as may be prescribed by the Central Government.

(3) Where an application for the renewal of a driving licence is made previous to, or not more than thirty days after the date of its expiry, the fee payable for such renewal shall be such as may be prescribed by the Central Government in this behalf.

(4) Where an application for the renewal of a driving licence is made more than thirty days after the date of its expiry, the fee payable for such removal shall be such amount as may be prescribed by the Central Government: Provided that the fee referred to in sub-section (3) may be accepted by the licensing authority in respect of an application for the renewal of a driving licence made under this sub-section if it is satisfied that the applicant was prevented by good and sufficient cause from applying within the time specified in sub-section (3):

Provided further that if the application is made more than five years after the driving licence has ceased to be effective, the licensing authority may refuse to renew the driving licence, unless the applicant undergoes and passes to its satisfaction the test of competence to drive referred to in sub-section (3) of section 9. (5) Where the application for renewal has been rejected, the fee paid shall be refunded to such extent and in such manner as may be prescribed by the Central Government.

(6) Where the authority renewing the driving licence is not the authority which issued the driving licence it shall intimate the fact of renewal to the authority which issued the driving licence."

(emphasis added)

19. It is beyond dispute that the licence would stand renewed automatically only if the application for renewal is filed within a period of thirty days from the date of expiry thereof. In such cases, even if an accident takes place within the afore- mentioned period, the driver may be held to be possessing a valid driving licence. The proviso to sub-section (1) of Section 15 makes it clear that the driving licence shall be renewed with effect only from the date of the renewal, in the event of an application for renewal of licence being made more than thirty days after the date of its expiry. That means, on the renewal of licence on such terms, the driver of the vehicle cannot be said to have been holding a valid driving licence from the date of expiry till the date of renewal.

20. We are of the definite view that Oriental Insurance Company v. Paulose (cited supra) does not lay down the correct law. Therefore the finding in the aforesaid case that the validity of driving licence continues to exist unless it has been shown that the licensee had been disqualified to hold one, in spite of expiry of its validity period as well as the failure to renew the same within the statutory period, needs a reversal.

21. We may now consider the incidental question whether the appellant/insurer in the present case can be exonerated from paying any amount or whether the appellant be directed to satisfy the award and allowed to recover the amount so paid from the insured, the second respondent.

22. Section 149 of the Act deals with the duty of the insurer to satisfy the awards against persons insured in respect of third party risks. It reads as follows:

(1) If, after a certificate of insurance has been issued under sub-section (3) of section 147 in favour of the person by whom a policy has been effected, judgment or award in respect of any such liability as is required to be covered by a policy under clause (b) of sub-section (1) of section 147 (being a liability covered by the terms of the policy) [or under the provisions of section 163A] is obtained against any person insured by the policy, then, notwithstanding that the insurer may be entitled to avoid or cancel or may have avoided or cancelled the policy, the insurer shall, subject to the provisions of the section, pay to the person entitled to the benefit of the decree any sum not exceeding the sum assured payable thereunder, as if he were the judgment debtor, in respect of the liability, together with any amount payable in respect of costs and any sum payable in respect of interest on that sum by virtue of any enactment relating to interest on judgments.

(2) No sum shall be payable by an insurer under sub-section (1) in respect of any judgment or award unless, before the commencement of the proceedings in which the judgment or award is given the insurer had notice through the Court or, as the case may be, the Claims Tribunal of the bringing of the proceedings, or in respect of such judgment or award so long as execution is stayed thereon pending an appeal; and an insurer to whom notice of the bringing of any such proceedings is so given shall be entitled to be made a party thereto and to defend the action on any of the following grounds, namely:-

(a) that there has been a breach of a specified condition of the policy, being one of the following conditions, namely:-

(i) a condition excluding the use of the vehicle--

(a) for hire or reward, where the vehicle is on the date of the contract of insurance a vehicle not covered by a permit to ply for hire or reward, or

(b) for organised racing and speed testing, or (c) for a purpose not allowed by the permit under which the vehicle is used, where the vehicle is a transport vehicle, or (d) without side-car being attached where the vehicle is a motor cycle; or

(ii) a condition excluding driving by a named person or persons or by any person who is not duly licensed, or by any person who has been disqualified for holding or obtaining a driving licence during the period of disqualification; or

(iii) a condition excluding liability for injury caused or contributed to by conditions of war, civil war, riot or civil commotion; or

(b) that the policy is void on the ground that it was obtained by the non-disclosure of a material fact or by a representation of fact which was false in some material particular.

(3) Where any such judgment as is referred to in sub-section (1) is obtained from a Court in a reciprocating country and in the case of a foreign judgment is, by virtue of the provisions of section 13 of the Code of Civil Procedure, 1908 (5 of 1908) conclusive as to any matter adjudicated upon by it, the insurer (being an insurer registered under the Insurance Act, 1938 (4 of 1938) and whether or not he is registered under the corresponding law of the reciprocating country) shall be liable to the person entitled to the benefit of the decree in the manner and to the extent specified in sub-section (1), as if the judgment were given by a Court in India:

Provided that no sum shall be payable by the insurer in respect of any such judgment unless, before the commencement of the proceedings in which the judgment is given, the insurer had notice through the Court concerned of the bringing of the proceedings and the insurer to whom notice is so given is entitled under the corresponding law of the reciprocating country, to be made a party to the proceedings and to defend the action on grounds similar to those specified in sub-section (2).

(4) Where a certificate of insurance has been issued under sub-section (3) of section 147 to the person by whom a policy has been effected, so much of the policy as purports to restrict the insurance of the persons insured thereby by reference to any condition other than those in clause (b) of sub-section (2) shall, as respects such liabilities as are required to be covered by a policy under clause (b) of sub-section (1) of section 147, be of no effect. Provided that any sum paid by the insurer in or towards the discharge of any liability of any person which is covered by the policy by virtue only of this sub-section shall be recoverable by the insurer from that person.

(5) If the amount which an insurer becomes liable under this section to pay in respect a liability incurred by a person insured by a policy exceeds the amount for which the insurer would apart from the provisions of this section be liable under the policy in respect of that liability, the insurer shall be entitled to recover the excess from that person.

(6) In this section the expression "material fact" and "material particular" means, respectively a fact or particular of such a nature as to influence the judgment of a prudent insurer in determining whether he will take the risk and, if so, at what premium and on what conditions, and the expression "liability covered by the terms of the policy" means a liability which is covered by the policy or which would be so covered but for the fact that the insurer is entitled to avoid or cancel or has avoided or cancelled the policy.

(7) No insurer to whom the notice referred to in sub-section (2) or sub-section (3) has been given shall be entitled to avoid his liability to any person entitled to the benefit of any such judgment or award as if referred to in sub-section (1) or in such judgment as is referred to in sub-section (3) otherwise than in the manner provided for in sub-section (2) or in the corresponding law of the reciprocating country, as the case may be.

Explanation.-- For the purpose of this section, "Claims Tribunal" means a Claims Tribunal constituted under section 165 and "award" means an award made by that Tribunal under section 168."

23. In Swaran Singh's case (cited supra), the Apex Court held that the liability of the insurance company vis-a-vis the owner would depend upon several factors. It was held that the owner would be liable for payment of compensation in case where the driver was not having licence at all, as it was the obligation on the part of the owner to take care to see that the driver had appropriate licence to drive the vehicle.

24. At this juncture, Mr. Mathews Jacob would argue that the question as to whether the owner of the offending vehicle, in the instant case, had taken care to inform himself as to whether the driver entrusted with the vehicle was having licence or not, does not arise at all as the second respondent was the owner-cum-driver of the offending vehicle. Therefore, the appellant cannot be mulcted with the liability; so submitted Mr. Mathews Jacob.

25. As observed in Swaran Singh's case (cited supra), for avoiding insurer's liability towards the insured even where the insurer is able to establish breach on the part of the insured concerning the policy condition regarding the holding of a valid licence by the driver, the insurer would not be allowed to avoid its liability towards the insured "unless the said breach or breaches or the condition of driving licence is so fundamental as are found to have contributed to the cause of the accident". Therefore, a mere technical violation like absence of a badge would not permit the insurer to avoid the liability of a third party.

(See the decision of the Full Bench of this Court in

National Insurance Company Ltd. v. Jisha K. P. & others [2015 (1) KLJ 82]).

26. In Swaran Singh's case (cited supra) it was further observed by the Apex Court that even after arriving at a conclusion that the insurer has satisfactorily proved its defence in accordance with the provisions of Sections 149(2) read with sub-section (7), it can be directed to satisfy the award reserving the insurer's right to recover the same from the insured. We see no reason why the said course shall not be followed in this case. It is relevant to note that the Apex Court in Ram Babu Tiwari v. United India Insurance Co. Ltd. (cited supra) did not interfere with the decision of the High Court directing recovery.

27. On a specific query put by us during the course of argument, both sides submitted that the appellant had satisfied the award. Therefore, we are of the view that the appellant insurance company shall be allowed to recover the amount paid by them to the first respondent, from the second respondent.

In the result:

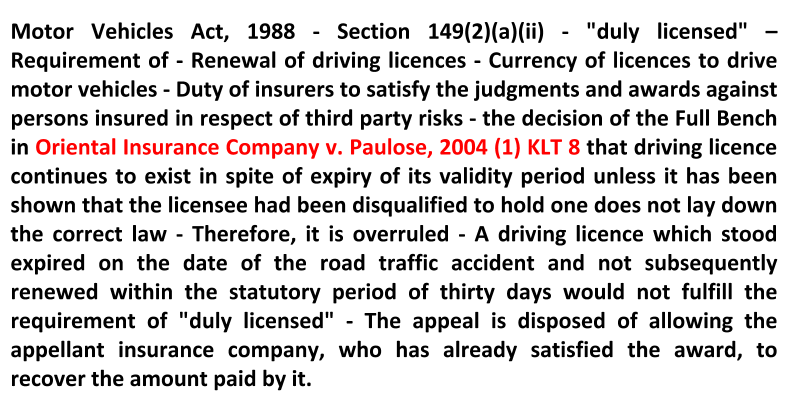

(a) We hold that the decision of the Full Bench in Oriental Insurance Company v. Paulose (cited supra) that driving licence continues to exist in spite of expiry of its validity period unless it has been shown that the licensee had been disqualified to hold one does not lay down the correct law. Therefore, it is over-ruled.

(b) We further hold that a driving licence which stood expired on the date of the road traffic accident and not subsequently renewed within the statutory period of thirty days would not fulfill the requirement of "duly licensed" under Section 149(2)(a)(ii) of the Act.

(c) The appeal is disposed of allowing the appellant insurance company, who has already satisfied the award, to recover the amount paid by it to the first respondent, from the second respondent who is the owner-cum-driver.